In the world of real estate investing, arrived vs fundrise has become a popular comparison for those seeking accessible, hassle-free ways to grow their portfolios. Both platforms offer unique approaches to real estate investment, catering to different types of investors. In this blog post, we’ll break down the key differences between Arrived and Fundrise, comparing their investment models, minimum investment requirements, fees, and more to help you decide which platform aligns with your financial goals.

Table of Contents

Investment Model

When comparing Arrived vs Fundrise, their investment models are notably different, offering distinct approaches to real estate investment.

Arrived Homes Investment Model

Arrived allows investors to purchase fractional shares of single-family rental properties. Investors can directly own a portion of an individual property, making it an attractive option for those who want a more hands-on approach to real estate ownership without the hassle of managing the property themselves. This model gives investors the feeling of direct property ownership, but in smaller, more affordable portions.

Key points about Arrived’s model:

- Fractional ownership of single-family homes.

- Investors earn income from rental payments.

- Long-term appreciation potential if property values increase.

- Investors can choose specific properties based on their preferences.

Fundrise Investment Model

Fundrise, on the other hand, operates on a crowdfunded REIT (Real Estate Investment Trust) model. Investors pool their money into a fund, which is then invested in a diversified portfolio of real estate assets, including residential, commercial, and industrial properties. This model offers more diversification but less direct control over individual property selection.

Key points about Fundrise’s model:

A more passive approach, with Fundrise managing the portfolio on your behalf.

Crowdfunded REIT structure.

Investments include a mix of property types.

Income comes from both dividends and property appreciation.

Minimum Investment

When it comes to the minimum investment required, Arrived vs Fundrise cater to different types of investors based on their financial capabilities and risk tolerance.

Arrived Homes Minimum Investment

Arrived offers a relatively low barrier to entry. The platform allows users to invest in real estate with as little as $100. This low minimum investment makes it accessible for beginner investors or those looking to test the waters with a smaller commitment. The ability to invest in fractional shares of single-family rental properties enables investors to participate in real estate without needing large sums of money upfront.

Key points about Arrived’s minimum investment:

- Minimum investment: $100.

- Ideal for beginner investors or those looking to start small.

- Flexible for diversifying across multiple properties with small amounts.

Fundrise Minimum Investment

Fundrise also has a low minimum investment, but it’s slightly higher compared to Arrived. To start investing with Fundrise, the minimum required is $10 for the Starter Portfolio. However, to access additional features, such as investing in more diversified portfolios or advanced tools, the minimum increases to $1,000 for the Core Portfolio.

Key points about Fundrise’s minimum investment:

Suitable for both small-scale investors and those looking for higher diversification.

Minimum investment: $10 for the Starter Portfolio.

$1,000 minimum for the Core Portfolio and advanced features.

Investment Types

Both Arrived vs Fundrise offer opportunities to invest in real estate, but the investment types available on each platform differ significantly, catering to varying investor preferences.

Arrived Homes Investment Types

Arrived focuses on providing fractional ownership in single-family rental properties. Investors can buy shares in individual homes that are rented out to tenants, generating rental income for the investors. This model is straightforward, allowing investors to select specific properties and benefit from potential appreciation in home values.

Key points about Arrived’s investment types:

- Single-family rental properties.

- Fractional ownership in individual homes.

- Income generated from rental payments.

- Investors can choose specific properties based on location, price, and projected returns.

Fundrise Investment Types

Fundrise, on the other hand, offers a more diverse range of real estate investments. Through its crowdfunded REITs (Real Estate Investment Trusts), Fundrise investors can gain exposure to a mix of property types, including:

- Residential properties (e.g., apartment buildings, single-family rentals).

- Commercial real estate (e.g., office buildings, retail spaces).

- Industrial properties (e.g., warehouses, logistics centers).

- Mixed-use developments.

Fundrise pools investor money into diversified portfolios, making it less about choosing individual properties and more about gaining broad exposure to various sectors of the real estate market.

Key points about Fundrise’s investment types:

- Diverse range of real estate investments: residential, commercial, industrial, and mixed-use.

- Investment through crowdfunded REITs.

- Automatic portfolio diversification based on selected investment plans.

Geographic Diversification

When comparing Arrived vs Fundrise on the basis of geographic diversification, each platform offers different strategies for spreading investments across various locations to manage risk.

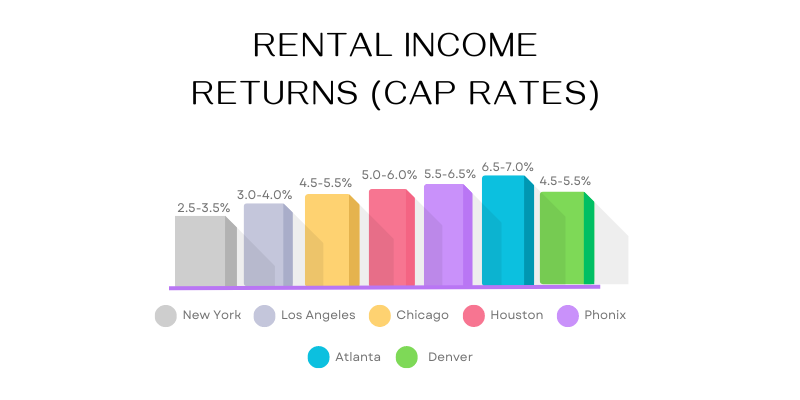

Arrived Homes Geographic Diversification

Arrived allows investors to choose specific properties in select cities across the United States. Investors can build their own geographically diverse portfolio by selecting single-family rental homes in various regions. However, the level of geographic diversification is entirely in the hands of the investor. If they focus on just one region or a few properties, their diversification may be limited, which could increase exposure to localized market fluctuations.

Key points about Arrived’s geographic diversification:

- Investors select individual properties in specific cities.

- Geographic diversification is based on the investor’s property choices.

- Investors must manage diversification across regions manually.

Fundrise Geographic Diversification

In contrast, Fundrise provides automatic geographic diversification through its REIT (Real Estate Investment Trust) model. When investors place their money into a Fundrise portfolio, they gain exposure to a wide range of properties in different regions of the U.S., including both urban and suburban markets. This model ensures that investors automatically benefit from a more diversified portfolio without needing to select individual properties.

Key points about Fundrise’s geographic diversification:

- Automatic exposure to a variety of regions and property types.

- Investors are diversified across residential, commercial, and industrial properties.

- Fundrise handles diversification as part of its broader investment strategy.

By offering these distinct approaches to geographic diversification, Arrived vs Fundrise presents options that cater to different investor preferences, whether you want to personally manage your property selection or prefer an automatically diversified portfolio.

Risk Profile

When assessing the risk profile of Arrived vs Fundrise, both platforms present different levels of risk based on their investment structures and property types.

Arrived Homes Risk Profile

Arrived focuses on single-family rental properties, meaning the risks are tied to the specific properties investors choose. Key risks include:

- Tenant risk: Vacancies or tenant defaults can directly impact rental income.

- Property-specific risks: Issues such as maintenance problems, natural disasters, or local market downturns can affect individual property performance.

- Concentration risk: Since investors select specific properties, there’s a risk of concentrating too much in one region or property type, which increases exposure to localized economic changes.

Investors with Arrived have more control over managing these risks by selecting multiple properties in different regions, but this requires active management and careful property selection.

Fundrise Risk Profile

Fundrise mitigates risk through its REIT model, which offers built-in diversification across various property types, including residential, commercial, and industrial real estate. The main risks include:

- Market risk: As with all real estate investments, overall market conditions can affect property values and rental income.

- Liquidity risk: Fundrise investments are less liquid than traditional stocks or bonds, with limitations on when investors can withdraw funds.

- Management risk: Since Fundrise manages all assets, investors rely on the platform’s expertise in property management and development.

Fundrise’s diversified portfolio helps spread risk across different regions and property types, offering a more passive investment approach compared to Arrived.

In comparing the risk profile of Arrived vs Fundrise, it comes down to whether you prefer hands-on management of specific properties and their associated risks or the automatic diversification and reduced control offered by a REIT structure.

Fees and Costs

When comparing Arrived vs Fundrise, understanding the fees and costs associated with each platform is crucial for investors. Both platforms have different fee structures that can impact your overall returns.

Arrived Homes Fees and Costs

Arrived charges several fees related to the purchase and management of properties. These fees typically include:

- Sourcing fee: A one-time fee that covers the cost of finding and acquiring the property, usually around 1% of the property value.

- Annual management fee: Charged for property management services, which includes overseeing the rental process, maintenance, and operations. This fee is around 8% of gross rental income.

- Other costs: Investors may also be responsible for operational costs, including maintenance and repairs, which can affect the profitability of the investment.

Key points about Arrived’s fees:

- Sourcing fee: Approximately 1% of the property value.

- Annual management fee: Around 8% of rental income.

- Investors bear some operational costs, such as repairs and maintenance.

Fundrise Fees and Costs

Fundrise has a more straightforward fee structure, though it includes both asset management and advisory fees:

- Annual advisory fee: Typically 0.15% of the total assets under management.

- Asset management fee: Generally 0.85% per year, which covers the ongoing management of the real estate assets in the portfolio.

- Additional fees: While Fundrise aims to keep costs low, investors might also encounter other fees related to project-specific expenses or the development of certain properties.

Key points about Fundrise’s fees:

- Advisory fee: 0.15% annually.

- Asset management fee: 0.85% per year.

- Some additional project-related fees may apply.

Here’s a table comparing the costs and fees of Arrived vs Fundrise:

| Fee Type | Arrived | Fundrise |

|---|---|---|

| Sourcing Fee | ~1% of property value | N/A |

| Annual Management Fee | ~8% of gross rental income | 0.85% asset management fee |

| Advisory Fee | N/A | 0.15% advisory fee |

| Other Costs | Maintenance and repair costs | Project-specific fees may apply |

| Minimum Investment | $100 | $10 (Starter), $1,000 (Core) |

Transparency of Information

In the comparison of Arrived vs Fundrise, transparency plays a crucial role in helping investors make informed decisions. Both platforms provide varying degrees of information about investments, fees, and performance updates.

Arrived Homes Transparency of Information

Arrived offers a high level of transparency by giving investors detailed insights into each property. Key elements of Arrived’s transparency include:

- Property-specific data: Investors can view detailed information about each rental property, including location, purchase price, projected rental income, and expected appreciation.

- Clear fee structure: Arrived provides a breakdown of all applicable fees, such as sourcing and management fees, before an investment is made.

- Regular performance updates: Investors receive ongoing updates about rental income, property maintenance, and other operational details, helping them stay informed about their investments.

This hands-on approach allows investors to make highly informed decisions about individual properties before committing their money.

Fundrise Transparency of Information

Fundrise emphasizes transparency through its portfolio-level reporting. While investors do not select individual properties, they are provided with comprehensive information about the performance of their portfolios. Key aspects include:

- Detailed portfolio breakdown: Fundrise offers regular reports on the properties included in an investor’s portfolio, detailing types of properties, locations, and performance metrics.

- Clear fee disclosures: Fundrise outlines its fees, such as advisory and asset management fees, upfront, so investors know what to expect.

- Quarterly updates: Investors receive quarterly performance reports that give insights into how their investments are doing, including returns, property developments, and market strategies.

Fundrise’s transparency allows investors to monitor their investments through regular, detailed reports without needing to manage individual properties.

In comparing Arrived vs Fundrise for transparency of information, Arrived excels in providing property-specific details, while Fundrise offers more comprehensive portfolio-level transparency, giving investors a clear view of how their money is performing in a diversified pool of assets.

Customer Support & Resources

A reliable customer support system and accessible resources are essential for any investment platform. Both Arrived vs Fundrise offer varying levels of support and educational resources to assist investors, but there are key differences between the two.

Arrived Homes Customer Support & Resources

Arrived provides investors with multiple ways to access customer support and resources:

- Customer support channels: Arrived offers support through email, live chat, and an online help center. The live chat is especially helpful for quick responses, while email support is available for more detailed inquiries.

- Educational resources: Arrived offers a blog and a resource center where investors can learn more about real estate investing, how the platform works, and market trends. The information is easy to understand, making it ideal for beginner investors.

- Property-specific insights: Investors can access detailed property reports, which provide financial projections and updates, ensuring they are well-informed about their investments.

Key points about Arrived’s customer support and resources:

- Multiple support channels: live chat, email, and an online help center.

- Educational blog and resource center for beginner and experienced investors.

- Detailed property insights provided for each investment.

Fundrise Customer Support & Resources

Fundrise also provides robust customer support and resources for investors:

- Customer support channels: Fundrise primarily offers email support and an online knowledge base. While the email support is reliable, the lack of live chat or phone support can be a limitation for investors looking for immediate assistance.

- Educational resources: Fundrise has an extensive blog, along with an investor education center. The platform provides in-depth articles on real estate investing, economic trends, and portfolio strategies, making it useful for both new and seasoned investors.

- Detailed portfolio reporting: Fundrise also excels at providing investors with comprehensive reports and updates on their portfolios, helping them understand how their investments are performing and what’s driving the returns.

Key points about Fundrise’s customer support and resources:

- Email support and a detailed online knowledge base.

- Comprehensive blog and investor education center with in-depth content.

- Regular, detailed portfolio reports to keep investors informed.

Tax Implications

Understanding the tax implications of investing with Arrived vs Fundrise is crucial for investors who want to maximize their after-tax returns. Both platforms have distinct tax structures, and it’s essential to know how they impact your investment income.

Arrived Homes Tax Implications

With Arrived, investors purchase fractional ownership in individual rental properties, so the tax treatment is similar to owning rental real estate. The key tax implications include:

- Rental income: Income earned from rental payments is considered taxable. Investors will receive a Form 1099-DIV outlining the amount of income earned, which must be reported on their tax returns.

- Depreciation benefits: Investors can benefit from depreciation deductions on their share of the property, which can reduce the taxable income from rental earnings.

- Capital gains tax: If the property appreciates and is sold for a profit, investors will be subject to capital gains tax. Long-term capital gains rates will apply if the property is held for more than a year.

- Property-specific deductions: Investors may also be eligible for deductions related to expenses like property maintenance and management fees, which can offset taxable income.

Key points about Arrived’s tax implications:

- Rental income is taxable and reported via Form 1099-DIV.

- Depreciation deductions can reduce taxable income.

- Capital gains tax applies when properties are sold.

- Property-related deductions may help offset taxes.

Fundrise Tax Implications

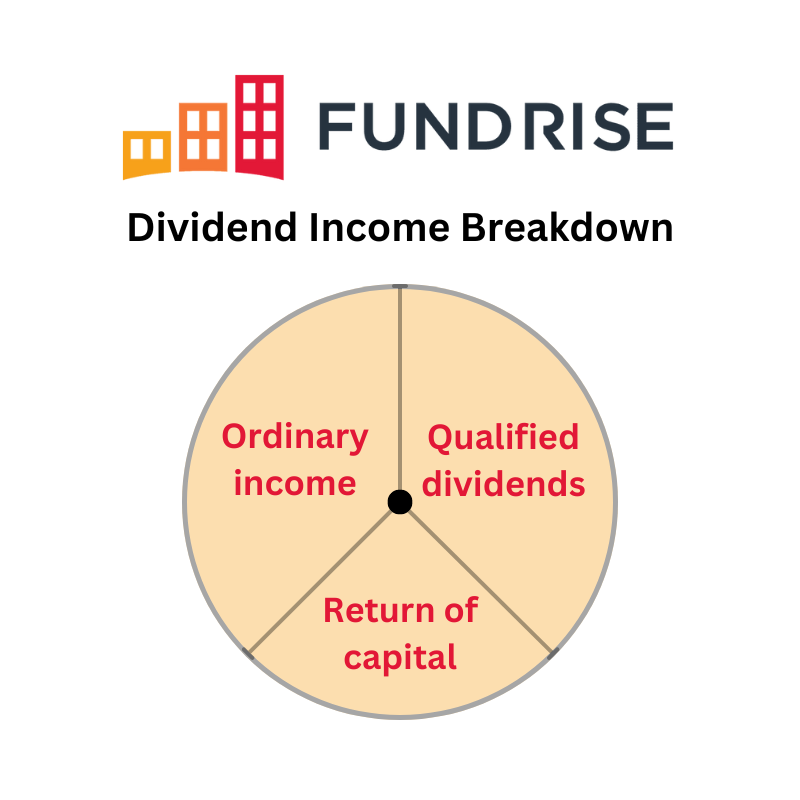

Fundrise investments are structured as REITs (Real Estate Investment Trusts), which have a different tax treatment compared to direct property ownership. The tax implications for Fundrise investors include:

- Dividend income: Investors receive dividend payments from the REIT, which are considered taxable income. These dividends are typically a mix of ordinary income, qualified dividends, and return of capital, each taxed at different rates. Fundrise will issue a Form 1099-DIV to report these earnings.

- Capital gains: If Fundrise sells assets at a profit, investors may also be liable for capital gains tax on their share of the gains.

- Return of capital: A portion of the dividends may be classified as a return of capital, which is not immediately taxable but reduces the investor’s cost basis, potentially increasing capital gains tax when the investment is sold.

Key points about Fundrise’s tax implications:

- Dividend income is taxable and reported via Form 1099-DIV.

- Dividends may include ordinary income, qualified dividends, and return of capital.

- Capital gains tax applies if assets are sold for a profit.

- Return of capital lowers the cost basis for future capital gains.

Conclusion: Which is The One For You?

When comparing Arrived vs Fundrise, both platforms offer unique real estate investment opportunities, but the right choice depends on your individual preferences, financial goals, and risk tolerance.

If you’re looking for a more hands-on approach with the ability to pick individual single-family rental properties and benefit from potential rental income and property appreciation, Arrived may be the better option. It offers a low barrier to entry with a $100 minimum investment and provides transparency through detailed property data and regular updates. However, with this approach, investors must manage their own geographic diversification and be aware of the risks tied to specific properties, including vacancy and maintenance costs.

On the other hand, Fundrise appeals to those seeking a more passive investment experience with automatic diversification across various property types, including residential, commercial, and industrial real estate. The REIT model ensures exposure to a broader portfolio, but it comes with lower liquidity and requires more trust in the platform’s management. With a $10 minimum investment for the Starter Portfolio, Fundrise is accessible to all types of investors, and its fee structure is clear and manageable. Investors should be aware of dividend taxation and capital gains when selling their shares.

Ultimately, choosing between Arrived vs Fundrise comes down to whether you want the ability to handpick individual properties or prefer the diversification and ease of a REIT-based platform. Both platforms offer real estate investment opportunities at low entry points, making them attractive for beginner and experienced investors alike.

Pingback: Seeking Alpha vs Motley Fool 2024: The Ultimate Guide to Choosing the Best Platform - Journey to Cash: Your Guide to Financial Freedom