When deciding between ETrade vs Vanguard, investors need to weigh a variety of factors to determine which platform aligns best with their financial goals. Both platforms are popular for different reasons: ETrade caters to active traders with its robust trading tools and wide variety of investments, while Vanguard is renowned for its low-cost index funds and long-term retirement planning. In this post, we’ll break down the key differences between ETrade and Vanguard, comparing everything from fees and investment options to customer support and user experience, so you can choose the platform that best fits your needs.

Table of Contents

Account Types

When comparing ETRADE vs Vanguard, one of the first things to consider is the variety of account types each platform offers. Both E*TRADE and Vanguard provide a wide range of account options, catering to different investment goals and financial needs.

ETRADE Account Types

E*TRADE offers a comprehensive selection of accounts, making it a flexible choice for both individual investors and families. Some of the key account types include:

- Individual and Joint Brokerage Accounts: Ideal for general investing and trading in stocks, ETFs, options, and bonds.

- Retirement Accounts (IRAs): ETRADE provides several types of IRAs, including Traditional, Roth, Rollover, and Beneficiary IRAs. This makes it easy to plan for long-term retirement savings.

- Custodial Accounts: For parents or guardians looking to invest on behalf of a minor.

- Business Accounts: ETRADE also offers accounts for small businesses, such as SEP IRAs and Simple IRAs, which are designed for self-employed individuals and small business owners.

ETRADE’s diverse account offerings make it a strong contender for investors with varied needs, whether you’re saving for retirement, general investing, or even managing business-related funds.

Vanguard Account Types

Vanguard, on the other hand, is well-known for its focus on long-term investing, particularly for retirement. While Vanguard’s range of accounts is slightly more specialized, it still provides everything most investors need:

- Individual and Joint Brokerage Accounts: Great for buying Vanguard’s low-cost mutual funds and ETFs, as well as other investments like stocks and bonds.

- Retirement Accounts (IRAs): Vanguard excels in retirement planning, offering Traditional, Roth, Rollover, and SEP IRAs. Vanguard is particularly popular for investors looking for low-cost, passive investment strategies over the long haul.

- 529 College Savings Plan: For investors saving for education, Vanguard offers tax-advantaged 529 plans.

- Trust and Estate Accounts: Vanguard provides accounts designed for estate planning and passing wealth to future generations.

While Vanguard may not offer as many niche accounts as ETRADE, its focus on retirement and long-term investing makes it a top choice for those seeking low fees and a straightforward approach to growing wealth.

| Account Types | ETRADE | Vanguard |

|---|---|---|

| Individual/Joint Brokerage | Yes | Yes |

| Retirement Accounts (IRAs) | Traditional, Roth, Rollover, Beneficiary IRAs | Traditional, Roth, Rollover, SEP IRAs |

| Custodial Accounts | Yes | No |

| Business Accounts | SEP IRAs, Simple IRAs | No |

| 529 College Savings Plan | No | Yes |

Investment Options

When evaluating ETrade vs Vanguard, understanding the range of investment options is essential. Both platforms offer a wide variety of choices, but they differ in some areas, making one platform potentially more suited to your specific investment strategy.

ETrade Investment Options

ETrade is known for its flexibility and wide range of investments. Whether you’re an active trader or a long-term investor, ETrade offers numerous options, including:

- Stocks: Access to thousands of stocks on major U.S. exchanges, as well as international markets.

- ETFs: A broad selection of commission-free ETFs from various providers, allowing investors to diversify across different sectors or strategies.

- Options: ETrade provides robust tools for options trading, catering to more experienced traders looking to leverage advanced strategies.

- Mutual Funds: Over 9,000 mutual funds, including no-transaction-fee options.

- Bonds: Access to U.S. Treasuries, municipal bonds, corporate bonds, and more, making it a good option for income-focused investors.

- Futures: For those looking for advanced trading strategies, ETrade also supports futures trading.

ETrade’s strength lies in its diverse range of investment products, making it appealing for both beginner investors and those seeking more advanced, niche strategies like options or futures trading.

Vanguard Investment Options

Vanguard is synonymous with low-cost, passive investing, and this is reflected in its investment offerings. Although its range of investment options is slightly narrower than ETrade, Vanguard excels in long-term, low-cost investment choices, particularly in the following areas:

- Stocks: Vanguard offers a solid selection of U.S. and international stocks, but its focus is more on long-term investing rather than active trading.

- ETFs: Vanguard is famous for its low-cost ETFs, which track various indexes and offer a low-cost way to gain broad market exposure.

- Mutual Funds: Vanguard’s primary strength lies in its mutual funds, particularly its index funds, which have some of the lowest expense ratios in the industry.

- Bonds: Vanguard offers a range of bond funds, both U.S. and international, catering to investors looking for fixed-income options.

- Target-Date Funds: A unique feature of Vanguard is its range of target-date retirement funds, which automatically adjust asset allocations based on the investor’s target retirement date.

While Vanguard doesn’t offer futures or options trading, it is the go-to platform for investors looking for long-term, low-cost investments, particularly in mutual funds and ETFs.

Fees and Commissions

When comparing ETrade vs Vanguard, understanding the fee structures and commissions is crucial for making the right choice, especially if you’re focused on keeping your costs low. Both platforms offer competitive pricing, but they differ slightly depending on the type of investor you are and how often you trade.

ETrade Fees and Commissions

ETrade offers a flexible pricing structure that caters to both frequent traders and long-term investors. Key points include:

- Stock and ETF Trades: ETrade charges $0 per trade for online U.S. stocks, ETFs, and options, making it highly competitive for investors looking to minimize trading costs.

- Options Trades: While options trades are commission-free, there is a $0.65 per contract fee. For high-volume traders (those making over 30 trades per quarter), the fee drops to $0.50 per contract.

- Mutual Funds: ETrade offers over 4,000 no-transaction-fee mutual funds. For other mutual funds, there is a $19.99 transaction fee.

- Bonds: For bonds, ETrade charges a $1 per bond fee on secondary market bond trades with a $10 minimum.

- Futures: There is a $1.50 per contract, per side fee for futures trades, catering to more advanced traders.

Overall, ETrade’s fee structure is designed to accommodate a wide variety of trading styles, from active day traders to those focused on long-term mutual fund investing.

Vanguard Fees and Commissions

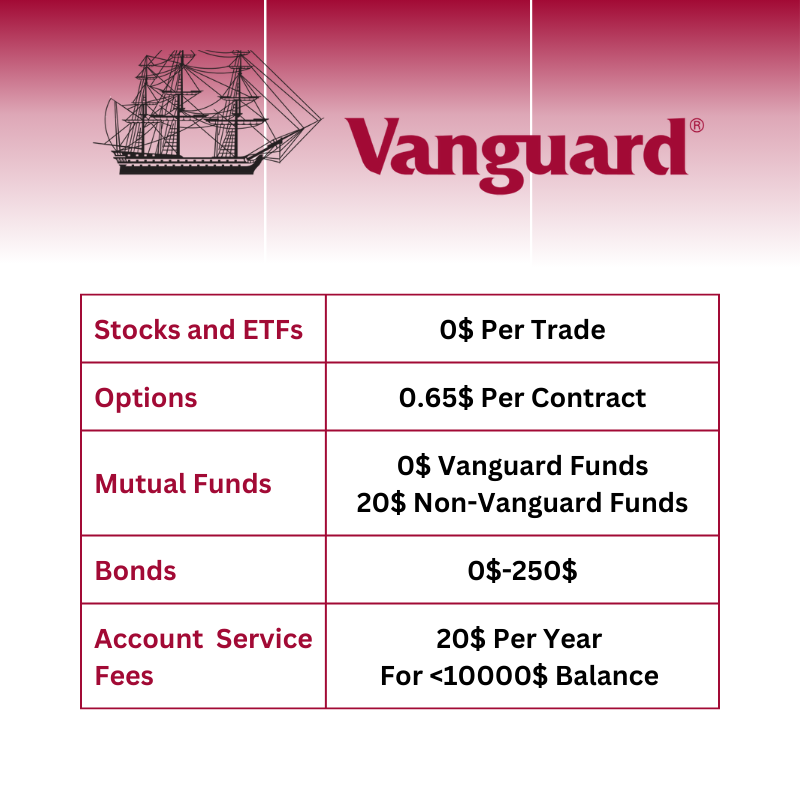

Vanguard has built its reputation on offering low-cost investments, particularly for long-term, passive investors. Key highlights include:

- Stock and ETF Trades: Like ETrade, Vanguard charges $0 per trade for stocks and ETFs. Vanguard’s primary appeal, however, lies in its proprietary low-cost ETFs, which are highly popular among passive investors.

- Options Trades: Vanguard charges $1 per options contract with no volume discounts, which makes it less appealing for high-frequency options traders compared to ETrade.

- Mutual Funds: Vanguard is famous for its low-cost mutual funds. Investors can trade Vanguard mutual funds with no transaction fees, but there is a $20 fee for non-Vanguard mutual funds.

- Bonds: Vanguard offers commission-free bond trades when buying and selling U.S. Treasuries and other government bonds. For other bonds, fees can range from $0 to $250 depending on the type and quantity of bonds.

- Account Service Fees: Vanguard charges an annual account service fee of $20 for balances under $10,000, though this fee can be waived if you sign up for electronic statements.

Vanguard’s fee structure is particularly appealing for investors focused on low-cost mutual funds and ETFs, while the lack of discounts on options trading may make it less attractive to active traders.

User Interface and Experience

When comparing ETrade vs Vanguard, the user interface and overall experience are key factors that can influence your decision, especially depending on your level of investment knowledge and frequency of trading.

ETrade User Interface and Experience

ETrade is widely praised for its modern, intuitive user interface, which caters to both novice investors and experienced traders. Key highlights include:

- Ease of Use: The ETrade platform is user-friendly, making it easy for beginners to navigate through various investment options, track portfolios, and place trades. The dashboard is customizable, allowing users to prioritize the information that matters most to them.

- Advanced Tools: ETrade is also well-suited for active traders. The platform offers advanced charting tools, real-time data, and technical analysis features. Its Power E*TRADE platform provides more sophisticated features like paper trading and risk analysis for options traders.

- Mobile App: The ETrade mobile app mirrors the web platform in terms of functionality, offering seamless access to all trading tools and account management features. This makes it easy for users to monitor and manage their portfolios on the go.

Overall, ETrade’s interface is designed to accommodate both beginners and advanced users, with a clean layout and robust trading tools that make it stand out for active traders.

Vanguard User Interface and Experience

Vanguard, while highly respected for its low-cost investment options, has a simpler and more functional interface compared to ETrade. It prioritizes long-term investors over active traders.

- Simplicity: Vanguard’s platform is straightforward and minimalist, which can be a plus for investors who prefer simplicity and are focused on long-term investments like mutual funds and ETFs. The dashboard provides clear access to portfolio information, account balances, and investment performance, but lacks the advanced trading tools of platforms like ETrade.

- Research and Education: Vanguard offers a wealth of educational resources, helping new investors understand their options and strategies. However, the research tools are basic compared to ETrade’s, with a focus on long-term investing rather than short-term trading strategies.

- Mobile App: Vanguard’s mobile app is functional but not as feature-rich as ETrade’s. It provides basic portfolio management and account viewing, but lacks many of the advanced charting and trading tools that more active traders might desire.

For users who value simplicity and long-term investing, Vanguard’s interface provides an easy-to-use, no-frills experience. However, those seeking more advanced tools may find it limited.

Trading Platforms

When assessing ETrade vs Vanguard, one of the most significant factors to consider is the trading platforms each service offers. Both platforms cater to different types of investors, with ETrade focusing more on active traders and Vanguard serving long-term, passive investors.

ETrade Trading Platforms

ETrade offers a versatile range of trading platforms that cater to both beginners and advanced traders:

- ETrade Web Platform: The standard web-based platform is intuitive and easy to use, making it suitable for investors of all experience levels. It provides a comprehensive view of your portfolio, real-time market data, and a range of educational resources.

- Power E*TRADE: Designed for active traders, the Power E*TRADE platform offers advanced charting tools, technical analysis, and customizable layouts. It also supports options trading, providing real-time streaming data, risk analysis tools, and strategy analysis to help traders make informed decisions. This platform stands out for those who need a more sophisticated setup.

- ETrade Pro: A downloadable platform available to high-volume traders, ETrade Pro offers even more advanced tools such as customizable dashboards, deep charting capabilities, and direct access to market makers. This platform is ideal for professional traders who need fast, real-time trading capabilities and more control over their investments.

- Mobile Trading: ETrade’s mobile app is one of the best in the industry, offering full functionality, including real-time quotes, trade execution, and advanced charting tools. This makes it perfect for investors who want to stay connected to the markets while on the go.

ETrade’s array of platforms caters to both casual and active traders, making it one of the more versatile offerings in the industry.

Vanguard Trading Platforms

Vanguard’s platform is built with long-term, passive investors in mind, focusing more on simplicity and ease of use rather than catering to active traders:

- Vanguard Web Platform: Vanguard’s web-based platform is straightforward and designed for long-term investors. It provides essential portfolio management tools, educational resources, and performance tracking but lacks the advanced trading features found in ETrade. The platform is intuitive but prioritizes long-term goals over short-term trading needs.

- Vanguard Mobile App: The Vanguard mobile app allows investors to manage their portfolios, check account balances, and monitor investment performance. It is functional but lacks the in-depth trading tools and customization options available on ETrade’s mobile platform. It’s best suited for those who don’t need to make frequent trades but still want access to their accounts while on the go.

Vanguard’s trading platform is best for investors focused on long-term wealth building, such as those investing in mutual funds, ETFs, and retirement accounts. However, it lacks the advanced features needed for active or day traders.

Customer Support

When deciding between ETrade vs Vanguard, customer support is an essential factor, especially if you expect to need assistance with your account or investment decisions. Both platforms offer support, but their availability, methods, and overall service quality differ.

ETrade Customer Support

ETrade is known for its responsive and accessible customer service, offering multiple ways to get help when needed:

- 24/7 Phone Support: ETrade provides round-the-clock phone support, ensuring that help is available anytime, even for late-night traders or those in different time zones.

- Live Chat: For those who prefer not to make a call, ETrade offers a live chat feature, making it easy to get quick answers to questions while using the platform.

- Email Support: ETrade also offers email support for less urgent queries, with relatively fast response times.

- Branches: ETrade has physical branches in select locations, allowing customers to meet with representatives in person for more complex issues or investment consultations.

- Knowledge Base: ETrade’s website has a detailed knowledge base and FAQ section that provides answers to common questions and tutorials on platform features.

The combination of 24/7 support, live chat, and in-person assistance makes ETrade’s customer service one of the more robust offerings for active traders or investors who may need immediate help.

Vanguard Customer Support

Vanguard also offers strong customer support but is more focused on assisting long-term, passive investors rather than active traders:

- Phone Support: Vanguard offers phone support during business hours (Monday to Friday), which is ideal for investors who need assistance during typical trading hours. However, it lacks the 24/7 availability of ETrade.

- Email Support: Vanguard provides email support, though response times can vary. For more complex inquiries, email may not be the fastest method.

- No Live Chat: Vanguard does not offer a live chat option, which can be a drawback for those who prefer instant online assistance.

- Personal Advisor Services: A unique feature of Vanguard is its Personal Advisor Services, where customers can work with a financial advisor to create personalized investment plans. This feature is highly valuable for long-term investors seeking professional guidance, though it comes at an additional cost.

- Online Resources: Vanguard offers a comprehensive knowledge base, including webinars, articles, and tutorials, to help investors learn about various topics, from retirement planning to portfolio management.

Vanguard’s customer support is excellent for long-term investors seeking advice on wealth building and financial planning. However, it lacks the 24/7 accessibility and live chat features that more active traders may find helpful.

Retirement and Long-Term Investing

When comparing ETrade vs Vanguard, one of the most important aspects to evaluate is how each platform supports retirement and long-term investing. Both companies offer a range of retirement accounts, but they take slightly different approaches in helping investors plan for their future.

ETrade for Retirement and Long-Term Investing

ETrade is a versatile platform that caters to both active and long-term investors, making it a solid choice for those looking to balance short-term trading with long-term financial goals.

- Retirement Account Options: ETrade offers a variety of retirement accounts, including Traditional IRAs, Roth IRAs, Rollover IRAs, and SEP IRAs, making it flexible for different retirement planning needs.

- Investment Options: Investors can choose from a wide range of investment vehicles, such as stocks, ETFs, mutual funds, and bonds. This variety allows retirement investors to create diversified portfolios that fit their risk tolerance and financial goals.

- Planning Tools: ETrade provides robust tools for retirement planning, such as retirement calculators and portfolio analysis tools. These resources help users understand their retirement readiness and make adjustments as needed.

- Target-Date Funds: ETrade also offers target-date funds, which automatically adjust the asset allocation based on the investor’s expected retirement date. These funds are ideal for hands-off investors who want a simple, long-term investment strategy.

While ETrade is known for its active trading features, its retirement planning options are comprehensive enough to meet the needs of long-term investors who want flexibility in their investment choices.

Vanguard for Retirement and Long-Term Investing

Vanguard has built its reputation on being one of the best platforms for long-term, low-cost investing, particularly when it comes to retirement planning.

- Retirement Account Options: Vanguard offers a wide range of retirement accounts, including Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and Rollover IRAs. Vanguard is particularly well-suited for retirement savers who want to focus on low-cost, long-term investments.

- Low-Cost Index Funds and ETFs: Vanguard is famous for its low-cost index funds and ETFs, which are ideal for long-term investors. The platform’s mutual funds have some of the lowest expense ratios in the industry, allowing investors to keep more of their returns over time.

- Target-Date Retirement Funds: Vanguard is a leader in offering target-date retirement funds, which automatically adjust the portfolio’s asset allocation as you near retirement. These funds are extremely popular with investors who want a “set it and forget it” approach to retirement saving.

- Personal Advisor Services: For investors who want more personalized guidance, Vanguard offers Personal Advisor Services, where financial advisors work with clients to build customized retirement plans. This service is particularly valuable for those who want professional help managing their long-term investments.

Vanguard’s focus on low-cost, passive investing and its expertise in retirement funds make it one of the best platforms for long-term retirement investors. Its expense ratios and broad selection of target-date funds are especially appealing to those focused on maximizing their retirement savings.

Security and Regulation

When comparing ETrade vs Vanguard, security and regulation are critical factors to consider. Both platforms are heavily regulated and provide robust security measures to protect their users’ accounts and investments. However, it’s essential to understand the specifics of how each platform safeguards your data and complies with financial regulations.

ETrade Security and Regulation

ETrade implements multiple layers of security to ensure that users’ personal information and investments remain protected:

- Encryption: ETrade uses 256-bit SSL encryption to secure all data transmitted between the platform and its users. This ensures that sensitive information, such as login credentials and financial transactions, remains private and protected from unauthorized access.Two-Factor Authentication (2FA): ETrade offers two-factor authentication as an additional layer of security. This means that users must provide a second form of identification, typically a code sent to their phone, when logging in or making transactions.Account Protection: ETrade provides Securities Investor Protection Corporation (SIPC) insurance for its users, protecting up to $500,000 in securities and $250,000 in cash in the event of broker-dealer failure. Additionally, ETrade offers additional insurance beyond SIPC limits for extra protection.Regulatory Oversight: ETrade is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). These agencies ensure that ETrade complies with the financial industry’s strict regulations and operates in a transparent and fair manner.

With these security measures and regulatory oversight, ETrade is well-equipped to protect its users’ data and investments from fraud and hacking attempts.

Vanguard Security and Regulation

Vanguard also employs top-tier security practices to ensure the protection of its users’ accounts and data:

- Encryption: Like ETrade, Vanguard uses 256-bit SSL encryption to secure communication between users and its platform, ensuring that data such as personal information and financial transactions are safe from cyber threats.Two-Factor Authentication (2FA): Vanguard provides two-factor authentication to protect user accounts from unauthorized access. This added layer of security ensures that even if a user’s password is compromised, their account remains secure.Account Protection: Vanguard’s accounts are also protected by SIPC insurance, covering up to $500,000 in securities and $250,000 in cash. This protection ensures that, in the event of a broker-dealer failure, your assets are insured up to these limits.Regulatory Oversight: Vanguard, like ETrade, is regulated by FINRA and the SEC. These regulatory bodies ensure that Vanguard complies with industry standards and operates within legal and ethical guidelines, providing further peace of mind for investors.

Vanguard’s security measures and regulatory oversight offer strong protection for long-term investors, ensuring that their retirement savings and investment portfolios are safe and compliant with industry standards.

Conclusion: Which One is Better For You?

In the ETrade vs Vanguard comparison, both platforms cater to different types of investors with distinct strengths. ETrade is ideal for active traders who need advanced tools, such as options and futures trading, real-time data, and a mobile app for managing investments on the go. The platform’s versatility also makes it a good choice for beginner investors, thanks to its user-friendly interface and educational resources.

On the other hand, Vanguard is the top choice for long-term, passive investors, especially those focused on building wealth through low-cost index funds and ETFs. It’s particularly strong for retirement-focused investors, offering excellent options like target-date funds and personalized retirement planning services. Additionally, cost-conscious investors will appreciate Vanguard’s low fees and the industry-leading expense ratios of its mutual funds and ETFs.

In summary, if you’re looking for a platform with more flexibility and tools for active trading, ETrade is a great option. However, if your primary goal is to invest passively and plan for the long term, Vanguard is the clear choice.

Pingback: IBKR Lite vs Pro 2024: Which Interactive Brokers Plan Is Right for You? - Journey to Cash: Your Guide to Financial Freedom