When comparing Personal Capital vs Quicken, it’s essential to understand the strengths and weaknesses of each platform to choose the right one for your financial needs. Whether you’re focused on investment tracking or comprehensive budgeting tools, this detailed comparison will help you decide which tool suits your goals. We’ll explore their features, pricing, and overall functionality to give you a clear picture of which platform is the better fit. Let’s dive in and see how Personal Capital vs Quicken stack up against each other!

Table of Contents

Pricing and Subscription Models

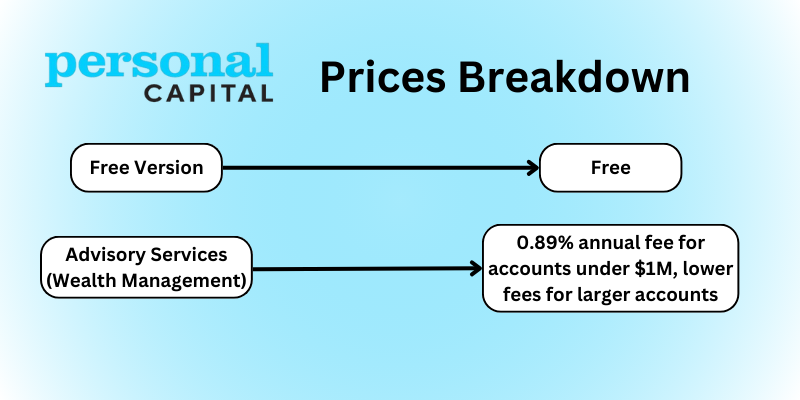

When comparing Personal Capital vs Quicken, pricing and subscription models play a key role in determining which tool is right for you. Personal Capital offers a mix of free and paid features, while Quicken operates on a subscription-based model.

Personal Capital provides its core features, like budgeting, cash flow management, and net worth tracking, entirely for free. However, if you want access to more advanced services like personalized investment advice and wealth management, you’ll need to opt for their advisory service. This comes with a fee that varies based on your portfolio size, starting at 0.89% for accounts under $1 million.

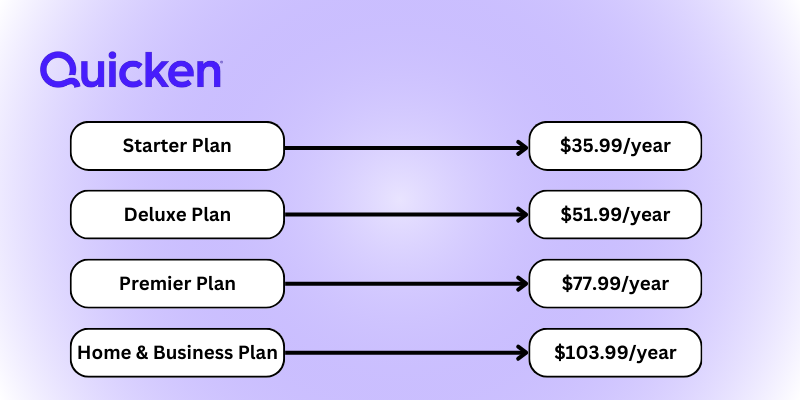

Quicken, on the other hand, follows a tiered subscription model, with four main plans: Starter, Deluxe, Premier, and Home & Business. Prices typically range from $35.99 to $103.99 per year, depending on the plan. Each tier offers different levels of access to budgeting tools, investment tracking, and advanced features like rental property management.

For users primarily interested in budgeting and basic financial tracking, Personal Capital’s free offering may be enough. However, if you need more comprehensive financial management, Quicken’s paid tiers provide a wider array of features. In short, Personal Capital vs Quicken boils down to whether you need free basic tools or are willing to pay for a more in-depth financial solution.

Budgeting Features

When comparing Personal Capital vs Quicken in terms of budgeting features, it’s clear that both platforms offer different approaches to managing your money.

Personal Capital focuses more on overall financial health rather than detailed, category-based budgeting. Its budgeting tools are basic, allowing users to track cash flow, income, and expenses. While it provides a broad view of your spending patterns, it doesn’t allow for in-depth budgeting categories or customization. This makes Personal Capital ideal for users who are more interested in tracking their net worth and monitoring general spending rather than setting strict budget limits for each expense category.

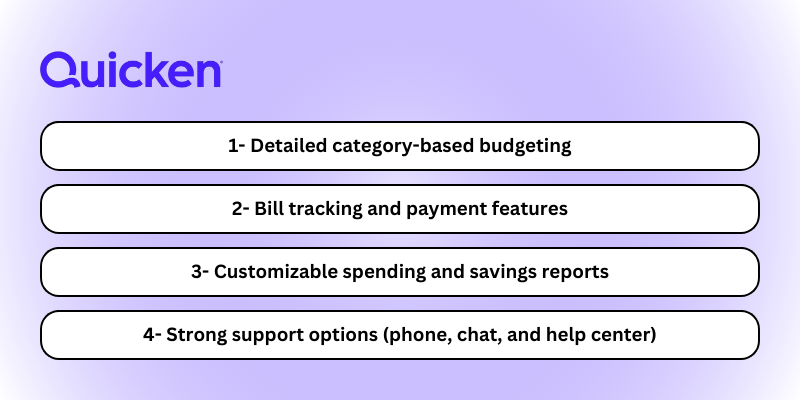

Quicken, on the other hand, excels in its budgeting capabilities. It offers highly detailed, category-based budgeting tools, allowing you to create custom budgets for different spending areas such as groceries, utilities, and entertainment. Quicken also lets you set spending goals, track your progress, and get alerts if you exceed your budget in any category. This makes it a powerful tool for users who want complete control over their spending and need a detailed financial plan.

In summary, if you’re looking for basic cash flow tracking, Personal Capital is a good choice. However, for more detailed and customizable budgeting, Quicken stands out as the better option.

Ease of Use

When evaluating Personal Capital vs Quicken in terms of ease of use, both platforms cater to different types of users, with varying levels of complexity in their design.

Personal Capital is known for its intuitive, clean, and user-friendly interface. Setting up your accounts and syncing them is straightforward, and the dashboard provides a comprehensive overview of your finances at a glance. It’s designed for users who want simplicity and quick access to key financial metrics like net worth, cash flow, and investment performance. Navigation through the app and web platform is smooth, making it ideal for users who prefer a minimal learning curve and easy access to their financial data.

Quicken, on the other hand, is more feature-rich but can feel more complex to navigate, especially for new users. Its extensive capabilities—covering everything from budgeting to investment tracking and bill payments—mean that it requires more time to fully understand and utilize. However, once set up, Quicken offers more in-depth control and customization. Its learning curve is steeper, but it provides more granular tools for those who are comfortable managing multiple aspects of their finances.

In summary, Personal Capital is better suited for users seeking a simple, easy-to-use interface with basic financial tracking, while Quicken offers more advanced features but requires more time and effort to master.

Mobile App Functionality

When comparing Personal Capital vs Quicken in terms of mobile app functionality, both platforms offer different strengths depending on the user’s needs.

Personal Capital provides a highly-rated mobile app that mirrors the clean, user-friendly experience of its desktop version. The app is available on both iOS and Android and allows users to track their net worth, cash flow, and investment portfolio directly from their phone. With its mobile app, you can easily sync your financial accounts, check real-time updates, and monitor your financial goals on the go. The app’s simplicity and seamless navigation make it ideal for users who want quick, on-the-go access to their financial data without being overwhelmed by too many features.

Quicken, while also offering a mobile app for iOS and Android, provides fewer functionalities compared to its desktop version. The mobile app is primarily used for basic tasks such as viewing account balances, tracking transactions, and categorizing expenses. It lacks some of the more advanced features available on the desktop, such as detailed investment tracking and comprehensive reports. However, for users who rely on Quicken’s detailed budgeting tools and account syncing, the app still serves as a convenient companion for managing their day-to-day finances.

In summary, the Personal Capital vs Quicken comparison in terms of mobile functionality shows that Personal Capital’s mobile app offers more robust features for tracking both cash flow and investments, while Quicken’s app is more of a basic companion to its desktop version.

Customer Support

When comparing Personal Capital vs Quicken in terms of customer support, the two platforms offer different levels of assistance based on their services and user needs.

Personal Capital provides customer support primarily for its paid advisory services. For users of the free version, support is more limited, typically available through email or an online help center with articles and guides. However, customers who use Personal Capital’s wealth management services gain access to a dedicated financial advisor, which includes personalized financial advice and ongoing assistance. This higher level of support is one of the key benefits of upgrading to their advisory service, especially for users managing larger portfolios.

Quicken, on the other hand, offers more extensive customer support options across all of its subscription plans. Quicken users can access support via phone, live chat, and an online help center, which includes FAQs and community forums. This makes it easier for users to resolve issues quickly, whether they’re facing technical problems, need help with account syncing, or want guidance on using specific features. Additionally, Quicken provides access to a team of experts who can assist with more complex issues for paid subscribers.

In summary, Personal Capital vs Quicken reveals that Quicken offers more accessible support options for all users, while Personal Capital reserves its premium customer support for wealth management clients.

Investment and Payments Tracking and Management

When comparing Personal Capital vs Quicken on investment and payments tracking and management, the two platforms offer distinct tools to cater to different financial needs.

Personal Capital excels in investment tracking and management. It’s designed primarily for users who want to monitor their portfolios and plan for long-term financial goals. Personal Capital’s investment tracking features include real-time portfolio performance updates, asset allocation analysis, and personalized retirement planning tools. The platform offers advanced features such as a fee analyzer, which helps you see how much you’re paying in investment fees, and a retirement planner that forecasts your financial future based on your investments and savings. For users focused on investments, Personal Capital is an excellent choice.

On the other hand, Quicken provides more comprehensive tools for bill tracking and payments. Quicken’s bill tracking feature lets users view upcoming bills and set reminders for due dates, ensuring that you never miss a payment. The platform also allows users to directly pay bills from within the app (for certain accounts), providing a seamless bill management experience. While Quicken does offer investment tracking, it is not as robust as Personal Capital. However, for users who want an all-in-one solution that combines budgeting, bill payments, and some investment tracking, Quicken is a more balanced option.

In summary, Personal Capital vs Quicken can be summarized as Personal Capital being the better choice for dedicated investment management, while Quicken offers more practical tools for everyday bill tracking and basic investment oversight.

Financial Planning and Reports

When comparing Personal Capital vs Quicken in terms of financial planning and reports, both platforms offer valuable tools but cater to different financial goals.

Personal Capital focuses heavily on long-term financial planning, particularly through its robust retirement planning tools. Users can access a wide range of reports that analyze their cash flow, net worth, and portfolio performance. The standout feature is the Retirement Planner, which allows users to input their financial goals and receive detailed projections of how their investments and savings will grow over time. The platform also offers tools like the Investment Checkup, which helps users optimize their portfolios for better returns. Personal Capital’s reports are easy to understand, making it an excellent option for users focused on long-term wealth building and retirement planning.

Quicken, on the other hand, provides more detailed and customizable reports for everyday financial management. Users can generate various reports, including spending trends, budgeting progress, and account balances. These reports are particularly useful for individuals looking to gain control over their daily expenses and short-term financial goals. Quicken also provides more granular control, allowing users to customize reports by category, date range, and specific accounts. While Quicken does offer some investment reports, its strength lies in tracking day-to-day financial health rather than long-term financial projections.

In summary, Personal Capital vs Quicken shows that Personal Capital is ideal for users who prioritize long-term financial and retirement planning, while Quicken offers more flexibility for users who want detailed reports on budgeting and short-term financial management.

Retirement Planning

When it comes to Personal Capital vs Quicken in retirement planning, the two platforms offer different levels of support, catering to users with varying needs.

Personal Capital is particularly strong in the area of retirement planning. Its Retirement Planner is one of the most comprehensive tools available, allowing users to project their retirement savings based on current assets, future contributions, and expected retirement dates. The tool incorporates factors like income, expenses, and life events, helping users see whether they’re on track to meet their retirement goals. Personal Capital also provides real-time simulations that adjust based on market performance, giving users a clear picture of how different scenarios could affect their retirement timeline. For those focused on long-term wealth building and retirement readiness, Personal Capital offers an impressive suite of tools.

Quicken, while offering basic retirement planning features, is more focused on day-to-day financial management. Users can track their retirement accounts and generate reports that provide an overview of their retirement savings, but Quicken lacks the advanced forecasting tools that Personal Capital provides. Quicken is best suited for users who want to monitor their retirement accounts alongside other aspects of their finances but don’t need in-depth retirement projections or advice.

In summary, Personal Capital vs Quicken highlights that Personal Capital is the superior choice for users who want detailed, forward-looking retirement planning tools, while Quicken serves those who prefer basic monitoring of their retirement savings within a broader financial management context.

Who Should Use Each?

When deciding between Personal Capital vs Quicken, it ultimately depends on your financial goals and management needs.

Personal Capital is ideal for users who are primarily focused on investment tracking and long-term financial planning. If you are someone looking to manage your investment portfolio, plan for retirement, or keep track of your net worth over time, Personal Capital’s comprehensive investment tools and wealth management services make it the better choice. Its intuitive interface and powerful retirement planner are tailored for those who prioritize growing their wealth and ensuring a secure financial future.

Quicken, on the other hand, is better suited for users who need a comprehensive personal finance management tool that covers day-to-day budgeting, bill payments, and expense tracking. It’s ideal for individuals or households that want more control over their monthly budgets, detailed spending reports, and easy bill management. While it does offer investment tracking, Quicken’s strengths lie in its ability to provide a complete overview of everyday finances, making it the go-to choice for users who want an all-in-one solution for managing various aspects of their financial life.

In summary, if your focus is on investment and retirement planning, Personal Capital is the way to go. If you need a detailed budgeting tool with solid support for bill management, then Quicken is the better option.

Pingback: Gohenry vs Greenlight: The Ultimate Comparison for Parents in 2024 - Journey to Cash: Your Guide to Financial Freedom