Experian sign up is a simple process that opens the door to valuable tools for managing your credit and strengthening your financial health. Whether you’re just starting to build credit or looking to improve your score, an Experian account provides access to your credit score, detailed reports, and innovative features like Experian Boost. In this guide, we’ll walk you through each step of signing up, from preparation to accessing tools that empower you to take control of your financial future.

Table of Contents

Introduction to Experian Sign Up Process

Signing up for Experian is a straightforward process that gives you access to valuable credit tools designed to help you monitor and improve your financial health. Experian, one of the major credit reporting agencies, provides essential credit information, including access to your credit score, reports, and financial insights. Whether you’re looking to track your credit history or take steps to improve your score, the Experian Sign Up process is your gateway to managing your credit with ease.

What to Expect from Experian Sign Up

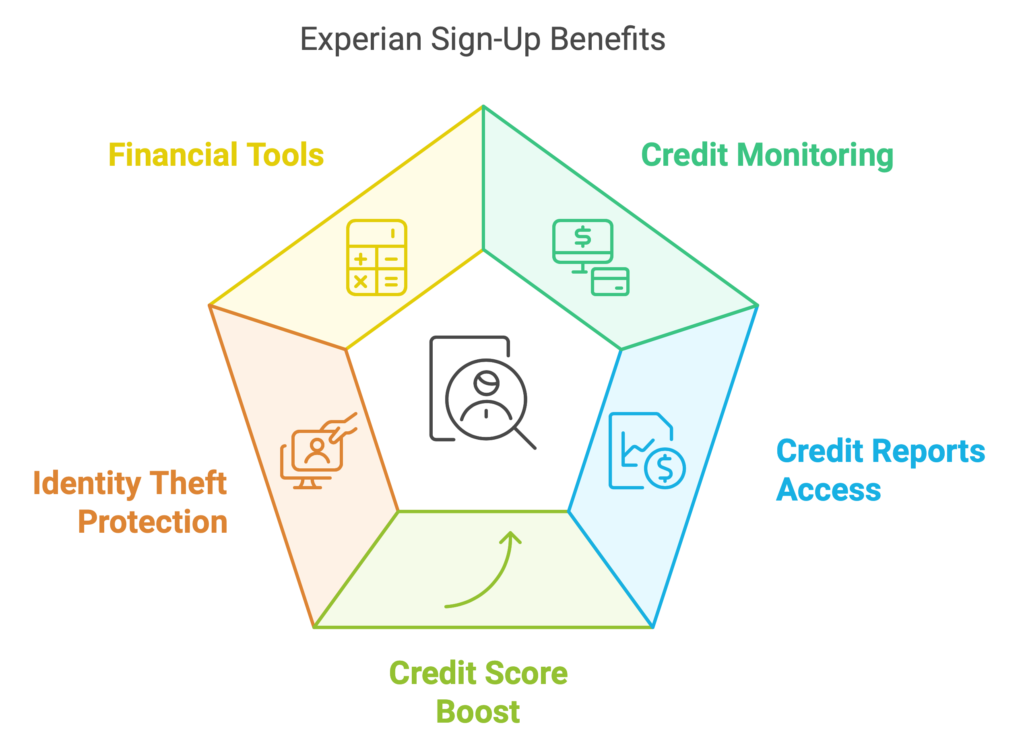

When you sign up for an Experian account, you gain access to various features, depending on the type of account you choose (free or premium). Experian’s services include:

- Credit Score Tracking: View your credit score anytime to stay aware of your financial standing.

- Credit Report Access: Get detailed credit reports to understand your credit history and factors affecting your score.

- Experian Boost: A free tool that can add positive payment history to your credit profile, potentially raising your score.

Each of these services can help you take control of your credit, making it easier to achieve financial goals like getting approved for loans, mortgages, or credit cards.

Why Experian Sign Up is Important

Completing the Experian Sign Up process is a great first step toward managing your credit health. With rising importance placed on credit scores for loan approvals, rental agreements, and more, having direct access to your credit information is essential. Experian provides the tools and data you need to make informed financial decisions, which can be especially useful if you’re planning to make a major purchase, build credit, or monitor for identity theft.

Increasing your credit score is essential for securing better loan terms and interest rates. According to the Consumer Financial Protection Bureau, maintaining a good credit score can impact your ability to borrow and even affect housing opportunities.

Why Completing Your Experian Sign Up is Important for Credit Health

Understanding and managing your credit is a critical part of achieving financial stability, and completing your Experian Sign Up is an essential step to take control of your credit health. With an Experian account, you gain access to important insights and tools designed to help you maintain a strong credit profile, make informed decisions, and protect yourself from identity theft. Here’s why signing up can make a positive difference for your financial well-being.

1. Stay Updated on Your Credit Score and History

Your credit score is a key factor in determining loan eligibility, interest rates, and even employment opportunities. By completing the Experian Sign Up process, you’ll be able to monitor your score regularly and understand the key factors influencing it. This insight helps you stay proactive and make decisions that benefit your credit health, whether you’re working to improve your score or maintain it at a high level.

2. Access to Free and Premium Credit Reports

Experian offers both free and premium options for viewing detailed credit reports, which provide a full picture of your credit history. Your credit report includes your payment history, credit utilization, and any current loans or credit lines. Reviewing these details after your Experian Sign Up can help you identify areas for improvement and spot any inaccuracies that may be negatively affecting your score.

3. Utilize Experian Boost to Increase Your Credit Score

One unique benefit of signing up with Experian is Experian Boost. This free tool allows you to add utility and telecom payments to your credit report, which can improve your credit score by reflecting positive payment history. Experian Boost is especially beneficial for those with limited credit history or for anyone looking to give their score a quick lift.

4. Early Detection of Identity Theft

Completing your Experian Sign Up also enables you to monitor for unusual activity in your credit report. With regular alerts for new credit inquiries, opened accounts, or any major changes, Experian helps you detect signs of identity theft early. This vigilance can prevent potential financial losses and ensure that your credit profile remains secure.

5. Take Advantage of Financial Tools and Insights

Beyond credit scores and reports, Experian provides additional tools that support financial planning. These tools include debt payoff calculators, credit simulators, and personalized recommendations based on your financial profile. By leveraging these resources, you can make smarter financial decisions and take action to enhance your credit standing.

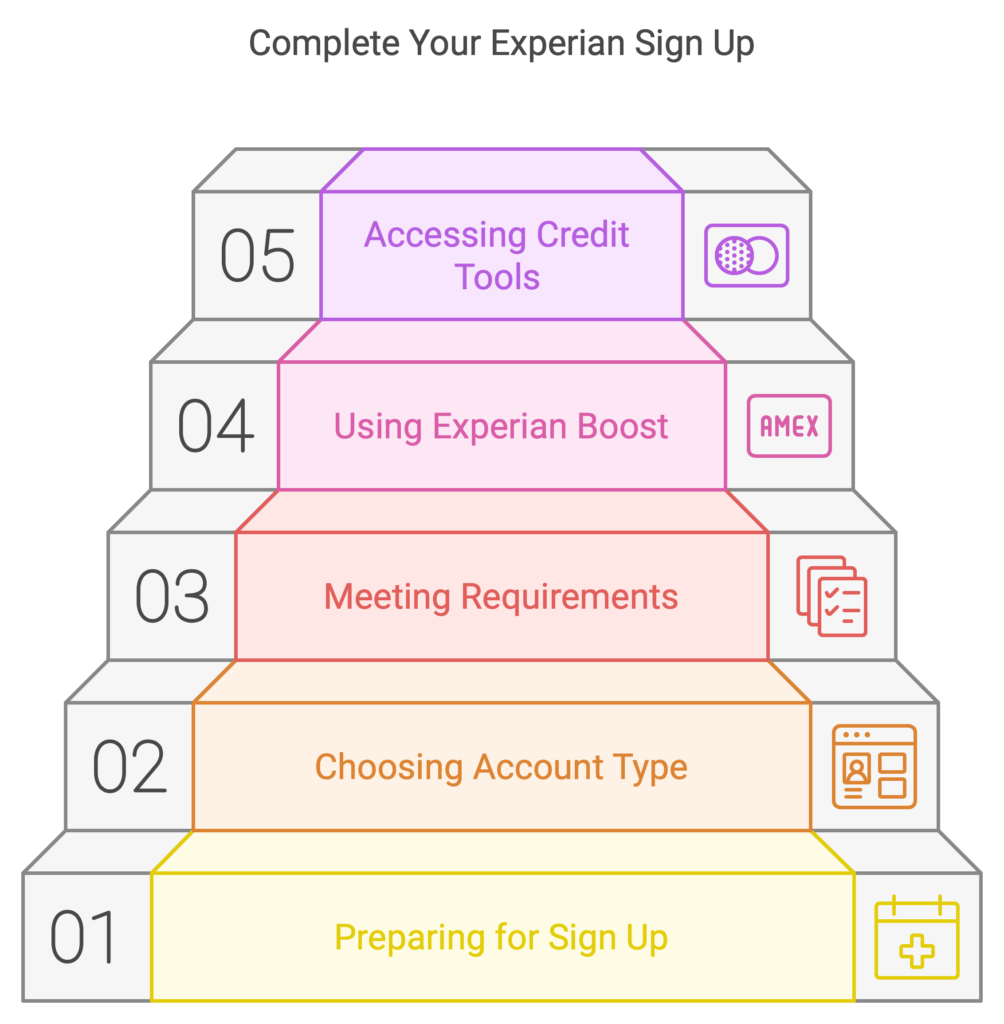

Step 1: Preparing for Your Experian Sign Up

Before starting your Experian sign up, it’s helpful to gather all necessary information to ensure the process is smooth and quick. Having these details ready will allow you to complete each step without interruption and set up your account with ease. Here’s what you’ll need and a few tips to make your sign up experience seamless.

Gather Personal Information

To sign up, you’ll need to provide some basic personal details. Make sure to have the following information on hand:

- Full Name: Use the exact name on your official documents to avoid discrepancies.

- Date of Birth: Experian requires your birth date to verify your identity.

- Social Security Number: Your SSN helps Experian access your credit information securely.

- Current Address: This should be your most recent address, as Experian uses it to verify your identity.

Having this information prepared will streamline your Experian sign up and help you avoid delays.

Verify Your Email and Set Up Security

Experian will require a valid email address to create your account and for any future notifications. After signing up, you’ll also need to set up security questions or two-step verification. Preparing a secure password and answers to common security questions in advance can make the process quicker and safer.

Choose Your Account Type: Free or Premium

Before completing your Experian sign up, it’s important to decide whether you want a free account or a premium membership. The free account includes basic access to your credit score and limited tools, while premium accounts provide enhanced features like identity theft protection and additional credit monitoring. Choosing your preferred account type early helps you know what to expect and select the option that fits your needs.

Consider Setting Up Experian Boost

If you’re interested in using Experian Boost to improve your credit score by adding utility and phone bill payments, prepare to set up online banking access. Experian Boost requires permission to connect to your bank accounts to verify on-time payments for these bills. This step is optional, but having your online banking credentials ready will make it easier to set up Boost after you’ve completed your sign up.

Step 2: Choosing Between Free and Premium Experian Accounts

When completing your Experian sign up, you’ll have the option to choose between a free account and a premium subscription. Each account type offers unique benefits, so selecting the one that aligns with your needs can make a difference in how effectively you manage your credit. Here’s an overview to help you decide.

Free Experian Account

The free Experian account provides access to essential credit tools at no cost, making it ideal if you’re looking to stay informed about your credit without a financial commitment. Key features of the free account include:

- Free Access to Your Experian Credit Score: Check your Experian credit score regularly, which is helpful for tracking changes and monitoring credit health.

- Basic Credit Monitoring: Receive alerts if there are any significant changes to your credit profile, such as new credit inquiries.

- Limited Credit Report Access: Get basic insights into your credit report to review general information, although details may be limited.

A free account is a good starting point for individuals wanting to keep an eye on their credit but not requiring in-depth credit analysis or identity theft protection.

Premium Experian Account

The premium Experian account offers an expanded range of services and is tailored for those seeking comprehensive credit monitoring, identity theft protection, and enhanced credit insights. The premium features include:

- Full Access to Your Credit Reports: View all three credit bureau reports (Experian, Equifax, and TransUnion) for a complete picture of your credit standing.

- Daily Credit Score Updates: Track changes to your credit score on a daily basis, which can be useful if you’re actively working on credit improvement.

- Identity Theft Protection: Benefit from advanced security features like identity monitoring, fraud resolution support, and even insurance coverage in case of identity theft.

- Experian Boost Integration: Boost is available with all accounts, but premium users often receive additional support to maximize their credit score with Boost.

A premium account is well-suited for those prioritizing a high level of credit monitoring and protection, especially if planning major financial decisions like buying a home or applying for loans.

Making the Right Choice

When choosing between free and premium, consider how involved you’d like to be with your credit management. If you’re looking for basic updates and occasional score monitoring, a free account could be enough. However, if you want daily updates, extensive credit information, and extra security, upgrading to premium may be the better option.

Step 3: Meeting the Experian Sign Up Requirements

To complete your Experian sign up smoothly, it’s essential to meet certain requirements and have all necessary information ready. Experian needs specific details to verify your identity and ensure your account is secure. Here’s what you’ll need to have on hand.

Basic Information Required

- Full Legal Name: Provide your complete name as it appears on official documents. This helps Experian match your identity with credit records accurately.

- Date of Birth: Your birthdate is needed to verify your age and eligibility, as Experian requires users to be at least 18 years old.

- Social Security Number (SSN): Your SSN is essential for Experian to access and match your credit information securely. It’s also used to verify your identity, making it a critical requirement.

- Current Address: You’ll need to enter your most recent address for identity verification. If you’ve recently moved, you may also need to provide your previous address.

Additional Verification Steps

In some cases, Experian may ask for additional information to confirm your identity. This might include answering personal questions related to your credit history, such as recent loans or past addresses. Be prepared for these steps, as they help ensure that only you can access your Experian account.

Email and Password Setup

Experian requires a valid email address for account setup and notifications. Ensure you use an email address you check regularly, as this will be the main method for communication and alerts. You’ll also need to create a secure password that meets Experian’s security standards, typically including a mix of letters, numbers, and symbols.

Security Questions for Account Protection

To further protect your account, Experian may prompt you to select and answer security questions. Preparing answers in advance can help speed up the process, and choosing questions that only you can answer accurately strengthens your account’s security.

Preparing for Optional Experian Boost

If you’re planning to use Experian Boost after signing up, it’s helpful to have your online banking login information ready. Experian Boost works by securely connecting to your bank accounts to verify positive payment histories for utility and telecom bills. While this step is optional, being prepared can help you set up Boost quickly if you decide to use it.

Step 4: Using Experian Boost After Completing Your Sign Up

After completing your Experian sign up, one powerful tool you’ll have access to is Experian Boost. This unique feature can help improve your credit score by including positive payment histories that traditional credit reporting may overlook. Here’s how Experian Boost works and how to use it effectively.

What is Experian Boost?

Experian Boost is a free service that allows you to add positive payment history for utility bills, phone bills, and select streaming services to your credit report. Since these types of bills are often not included in credit calculations, Experian Boost gives you the opportunity to improve your credit score by incorporating these regular payments.

How to Set Up Experian Boost

To start using Experian Boost, follow these simple steps after signing in to your account:

- Connect Your Bank Accounts: Experian Boost requires access to your bank accounts to identify eligible payments. You’ll need to securely link any bank account you use to pay utility or phone bills.

- Verify Payment History: Once connected, Experian Boost will scan your payment history to identify on-time payments for utility, phone, and select streaming services.

- Confirm and Add Payments: After the scan, you’ll have the option to review and confirm the payments you’d like added to your credit file.

Benefits of Using Experian Boost

Experian Boost can help raise your FICO Score almost instantly by adding these positive payments. This tool is particularly beneficial for individuals with limited credit history or those who have a “thin file,” as it provides a more complete view of your financial reliability. Experian Boost only reports positive payments, so there’s no risk of lowering your score if you miss a bill payment.

How Often to Use Experian Boost

Experian Boost allows for regular updates, meaning you can refresh your account connection every few months to include any new eligible payments. This keeps your credit file up-to-date with recent on-time payments and may continue to boost your score over time.

Checking the Impact of Experian Boost on Your Credit Score

After adding payments through Experian Boost, you’ll see the impact on your Experian credit score right away. Monitoring this change can help you understand how your regular bills contribute to your overall credit health, giving you valuable insight into your financial habits.

Step 5: Accessing Your Credit Tools After Experian Sign Up

Once your Experian sign up is complete, you’ll have access to a suite of credit tools designed to help you monitor, manage, and improve your credit health. These tools provide valuable insights, allowing you to stay informed and make better financial decisions. Here’s a breakdown of the main features you’ll find in your Experian account.

Credit Score Tracking

With your Experian account, you can regularly check your credit score. Monitoring your score over time is essential for understanding how your financial behaviors—such as paying bills on time or reducing debt—affect your credit health. Free users can see their Experian credit score, while premium members may have access to scores from all three major credit bureaus.

Access to Detailed Credit Reports

Your Experian account includes access to credit reports that contain key information about your credit history, including open accounts, credit balances, and payment records. Reviewing this report allows you to identify factors that may be impacting your score, spot inaccuracies, and gain insight into your financial strengths and weaknesses.

- Free Members: Limited access to Experian credit reports.

- Premium Members: Access to reports from Experian, Equifax, and TransUnion for a comprehensive credit view.

Real-Time Credit Monitoring Alerts

Experian’s credit monitoring feature provides alerts for changes to your credit file, such as new credit inquiries, account openings, or significant balance changes. These alerts keep you informed about any unusual activity that might affect your score, helping you to detect potential fraud early and take action if necessary.

Experian Boost for Enhanced Credit Scores

Experian Boost is a valuable tool that allows you to improve your credit score by including positive payment histories for utility and telecom bills. If you haven’t already set it up, Experian Boost is easy to activate and can provide a quick score increase.

Identity Theft Protection and Security Features (Premium)

For premium members, Experian provides additional tools for identity theft protection, including dark web monitoring, identity theft insurance, and fraud resolution support. These features offer an added layer of security, protecting your credit profile from potential threats and giving you peace of mind.

Personalized Financial Tools

Experian also provides a range of financial tools to help you manage debt, simulate the impact of credit decisions, and plan for financial goals. Tools like credit score simulators and debt payoff calculators allow you to see how various actions—such as paying down a credit card or taking out a loan—might impact your score.

Troubleshooting Common Issues During Experian Sign Up

While the Experian sign up process is designed to be straightforward, users may occasionally encounter issues that prevent a smooth experience. Here are some common sign-up challenges and solutions to help you overcome them and complete your registration successfully.

1. Verification Issues with Personal Information

One of the most common issues users face is the verification of personal information, such as name, Social Security Number (SSN), or date of birth. If Experian can’t verify your identity, ensure that:

- Details Match Official Records: Double-check that your name, SSN, and birth date match what’s on your legal documents.

- Address is Up-to-Date: If you recently moved, try using a previous address, as credit records might not yet reflect your new one.

If you still encounter issues, you may need to contact Experian support for assistance with verification.

2. Problems with Security Questions

Experian sign up process often requires users to answer security questions based on credit history, such as previous addresses or past loans. If you have difficulty answering these questions:

- Take Your Time: Ensure you’re answering based on credit records rather than recent memory, as questions are generated from older records.

- Retry Later: Experian may allow you to try again after a short wait if you initially struggle with responses.

3. Email Verification Delays

After entering your email, you’ll receive a verification email to confirm your address. If you don’t see it in your inbox:

- Check Spam or Promotions Folders: Sometimes, verification emails are filtered into these folders.

- Resend the Email: Experian usually provides an option to resend the verification email, so use this if the email hasn’t arrived within a few minutes.

4. Password Setup Issues

Experian requires a strong password that includes a mix of letters, numbers, and symbols. If you’re having trouble creating a password:

- Follow Password Requirements: Ensure you’re meeting all Experian’s password criteria.

- Use a Password Manager: Consider using a password manager to create and save a strong, complex password that meets these requirements.

5. Experian Boost Connection Errors

If you plan to use Experian Boost, you may need to link your bank account to track eligible payments. Occasionally, users experience connection errors during this process. If this happens:

- Double-Check Login Credentials: Make sure your online banking login information is accurate.

- Retry Later: Bank servers may sometimes be temporarily unavailable, so trying again after a short wait can help resolve this issue.

6. Contacting Experian Support

If troubleshooting steps aren’t resolving the issue, reaching out to Experian support may be necessary. You can find Experian’s support contact options on their website, where you can request help via phone, email, or chat.

Conclusion: Experian Sign Up for Better Financial Health

Completing your Experian sign up is a practical step toward taking control of your credit health and financial future. With access to credit monitoring, detailed reports, and tools like Experian Boost, you’ll be better equipped to stay on top of your credit profile and make informed financial decisions. Experian’s features provide peace of mind, helping you detect any potential fraud early, understand factors influencing your credit score, and make adjustments to improve your financial standing.

Whether you choose a free or premium account, Experian offers valuable insights that empower you to monitor your credit, build a stronger financial foundation, and work towards your goals. For anyone looking to enhance their financial health, Experian sign up is a step in the right direction.

Pingback: How is MyFICO Accurate Compared to Other Credit Monitoring Services in 2024? - Journey to Cash: Your Guide to Financial Freedom