If you’re considering options for managing your debt, you’ve likely come across JG Wentworth reviews and wondered if their services are the right fit for you. JG Wentworth Debt Relief is a well-known solution for individuals struggling with unsecured debt, offering a way to reduce what you owe through negotiation with creditors. In this comprehensive review, we’ll dive into the details of their services, customer experiences, fees, and how they compare to competitors, helping you decide if JG Wentworth is the best choice for your financial needs.

Table of Contents

Background of JG Wentworth

JG Wentworth, established in 1991, is a well-known financial services company that initially started by purchasing structured settlements and annuities. Over the years, it expanded its services to include debt relief, helping individuals manage and reduce their unsecured debts through negotiation and settlement with creditors. The company has gained significant recognition due to its extensive advertising campaigns, making it one of the most familiar names in financial assistance.

JG Wentworth Debt Relief services focus on helping clients consolidate and reduce their debt, offering an alternative to more drastic measures like bankruptcy. The company works with clients facing overwhelming credit card debt, medical bills, and personal loans, negotiating with creditors to lower the total amount owed. This approach makes JG Wentworth a potentially attractive option for individuals looking to regain control over their financial situation without taking out more loans.

With over three decades in the industry, JG Wentworth has built a reputation for being reliable and experienced. However, it’s essential to carefully assess customer reviews and understand the fee structures and the overall process before committing to any debt relief program.

JG Wentworth Debt Relief Services Overview

JG Wentworth offers debt relief services designed to help individuals struggling with unsecured debt, such as credit card debt, medical bills, and personal loans. The goal of JG Wentworth Debt Relief is to negotiate with creditors to lower the total amount owed, helping clients pay off their debts faster and for less than the original balance.

The debt relief process typically begins with a free consultation where a representative reviews the client’s financial situation to determine if they qualify for the program. Once enrolled, JG Wentworth works with creditors on behalf of the client to negotiate settlements, while the client makes monthly payments into a dedicated account that is used to pay off the negotiated settlements over time.

JG Wentworth Debt Relief is particularly useful for individuals who are behind on payments or who can no longer manage high-interest debt. The service can provide an alternative to bankruptcy or debt consolidation loans, offering a way to resolve debt without taking on additional credit. However, it’s important to note that debt settlement can affect credit scores, and clients may face fees for the service.

Overall, JG Wentworth Debt Relief is designed to provide relief for those dealing with large amounts of unsecured debt, allowing them to regain control of their finances through structured settlements with creditors.

Eligibility for JG Wentworth Debt Relief

To be eligible for JG Wentworth Debt Relief, individuals must meet specific criteria related to their financial situation and the type of debt they carry. JG Wentworth primarily helps clients with unsecured debts, which include credit card debt, medical bills, personal loans, and some types of private student loans. The program is not designed to assist with secured debts, such as mortgages or car loans, where collateral is involved.

Generally, JG Wentworth Debt Relief is best suited for individuals who are experiencing significant financial hardship and are unable to keep up with their monthly debt payments. Those who are behind on payments or who are facing the possibility of defaulting on their debts are typically good candidates for the program. In most cases, clients should have at least $10,000 in unsecured debt to qualify, although this amount may vary depending on the specifics of each situation.

It’s important to note that while JG Wentworth Debt Relief can help many people struggling with debt, the program may not be appropriate for everyone. Individuals considering debt relief should evaluate how it may impact their credit scores and whether they are comfortable with the potential long-term effects on their financial health.

JG Wentworth’s Fees and Costs

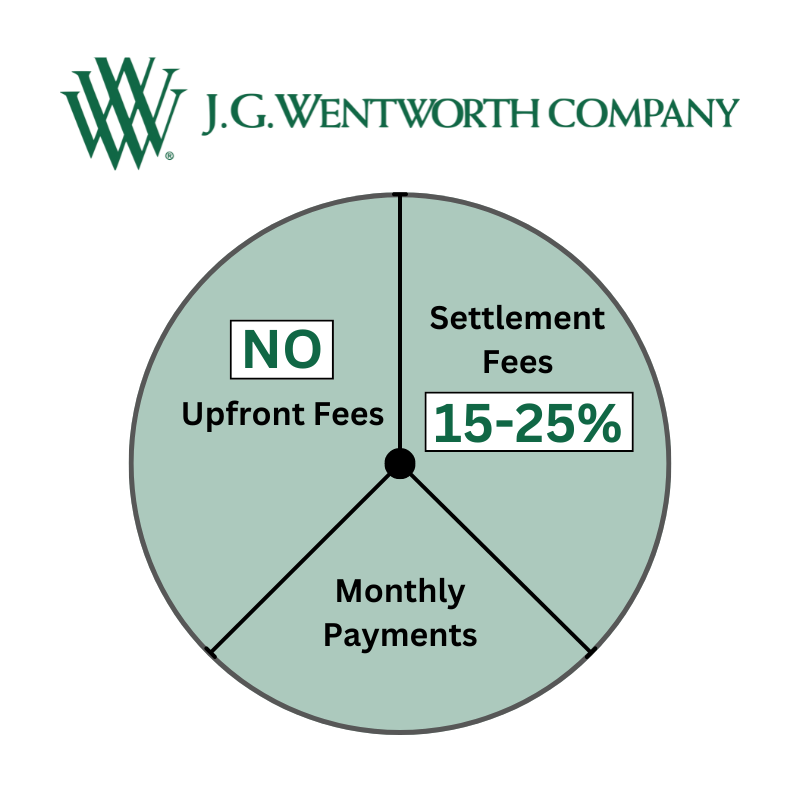

When considering JG Wentworth Debt Relief, it’s essential to understand the fees and costs associated with the service. Like many debt relief companies, JG Wentworth charges fees based on a percentage of the debt enrolled in the program or a percentage of the savings negotiated with creditors. These fees typically range from 15% to 25%, depending on the complexity of the case and the amount of debt involved.

JG Wentworth does not charge upfront fees, which is a positive aspect of their service. Instead, clients are only charged once a settlement agreement is reached with a creditor and the debt is successfully resolved. This ensures that clients are not paying for services before seeing any results.

While the fees can seem high, it’s important to weigh them against the potential savings JG Wentworth may negotiate on your behalf. If the company is able to significantly reduce the total amount owed, the overall savings can outweigh the cost of the service. However, it’s crucial for clients to fully understand these fees and factor them into their overall debt relief plan before enrolling.

In addition to the fees, clients may need to maintain a dedicated savings account to fund the negotiated settlements, which is separate from their usual checking account. This account is used to accumulate funds for settling debts as agreements are reached.

JG Wentworth Reviews: Customer Experience

Customer experience is a key factor to consider when evaluating any debt relief service, and JG Wentworth reviews provide valuable insights into how clients perceive the company. Many JG Wentworth Debt Relief clients report positive experiences, particularly when it comes to the company’s ability to negotiate lower settlements and the professionalism of its customer service team. Clients often praise the clarity of the process, noting that JG Wentworth is transparent about how the program works and what to expect.

However, like any service, JG Wentworth has received some mixed reviews. While many customers are satisfied with the savings achieved through debt settlement, others express frustration with the time it takes to complete the process. Debt relief is not a quick fix, and the process can take several months to years, depending on the client’s financial situation. Some clients have also noted that their credit scores were negatively impacted during the settlement period, which is a common issue with debt relief programs.

Overall, JG Wentworth reviews highlight that while the service can provide significant financial relief, it’s essential for clients to fully understand the potential impact on their credit and be prepared for the length of time the process may take. Clear communication with the company throughout the process can help mitigate concerns and ensure a smoother experience.

JG Wentworth’s Approach to Debt Settlement

JG Wentworth’s approach to debt settlement is designed to help clients reduce their unsecured debt through negotiations with creditors. The process typically starts with a free consultation, during which a debt specialist reviews the client’s financial situation and determines whether JG Wentworth Debt Relief is the right solution for them. Once a client is enrolled, the company works to negotiate with creditors to settle the debt for less than what is owed.

JG Wentworth’s debt settlement process involves several steps. First, the client stops making payments to their creditors and instead deposits funds into a dedicated savings account managed by the client. Over time, these funds accumulate and are used to pay the settlements once agreements are reached. As settlements are negotiated, JG Wentworth will contact the creditors on the client’s behalf and attempt to lower the total amount owed. Once a settlement is accepted, the funds from the savings account are used to pay off the reduced balance.

This approach can be effective in helping clients save money and pay off their debts more quickly than through minimum payments alone. However, it’s important to note that debt settlement can negatively affect credit scores since missed payments are part of the strategy. Additionally, there are no guarantees that every creditor will agree to settle, which could impact the overall effectiveness of the program.

JG Wentworth’s approach to debt settlement offers an alternative to debt consolidation or bankruptcy, making it an option for clients seeking a structured way to reduce their debt load without taking on more loans.

JG Wentworth vs Competitors

When comparing JG Wentworth to its competitors in the debt relief industry, several key factors differentiate it from other companies offering similar services. While JG Wentworth Debt Relief is a well-known and reputable option, understanding how it stacks up against competitors can help potential clients make an informed decision.

One major advantage of JG Wentworth is its long-standing presence in the financial services industry. With over 30 years of experience, JG Wentworth has built a strong reputation for trustworthiness and professionalism. In comparison, some competitors may not have the same level of experience or industry recognition, which could influence a client’s confidence in their services.

Another aspect where JG Wentworth stands out is its transparency regarding fees. While many debt relief companies charge hidden or upfront fees, JG Wentworth only charges fees once a debt settlement has been successfully negotiated, which aligns with best practices in the industry. However, some competitors may offer slightly lower fees or more flexible payment terms, making it important for clients to compare options based on their financial situation.

In terms of customer service, JG Wentworth has received positive reviews for its clear communication and support throughout the debt settlement process. Competitors such as National Debt Relief and Freedom Debt Relief also receive favorable reviews for customer service, though individual experiences may vary.

When it comes to debt types handled, JG Wentworth focuses primarily on unsecured debt, like credit card debt and medical bills, similar to its main competitors. However, some competitors may offer additional services, such as debt management plans or bankruptcy counseling, which could be more suitable for individuals with diverse financial needs.

| Feature | JG Wentworth | National Debt Relief | Freedom Debt Relief |

|---|---|---|---|

| Years in Business | 30+ | 12+ | 20+ |

| Fee Structure | 15-25% of settled debt | 15-25% of settled debt | 15-25% of settled debt |

| Upfront Fees | No | No | No |

| Service Focus | Debt Settlement | Debt Settlement | Debt Settlement |

| Minimum Debt Required | $10,000 | $7,500 | $7,500 |

| Time to Complete | 24-48 months | 24-48 months | 24-48 months |

| Effect on Credit Score | Negative during process | Negative during process | Negative during process |

| BBB Rating | A+ | A+ | A+ |

| Customer Support | Phone, Email, Online Portal | Phone, Email, Online Portal | Phone, Email, Online Portal |

JG Wentworth Reviews: Trustworthiness and Transparency

When it comes to debt relief services, trustworthiness and transparency are critical factors, and JG Wentworth has earned a solid reputation in these areas. Many JG Wentworth reviews highlight the company’s commitment to providing clear, upfront information about its services, fees, and the potential impacts of debt settlement on a client’s financial health.

One of the ways JG Wentworth demonstrates transparency is through its fee structure. Unlike some debt relief companies that charge upfront fees, JG Wentworth only charges clients once a successful debt settlement has been reached. This means clients don’t have to worry about paying for a service before seeing any results. Additionally, the company is clear about the range of fees, typically between 15% and 25%, depending on the amount of debt and the specifics of the case.

JG Wentworth is also upfront about the potential risks associated with debt settlement, including the possibility of negatively impacting a client’s credit score. This level of honesty helps clients understand what to expect and make informed decisions about whether debt relief is the right solution for them.

In terms of trustworthiness, JG Wentworth has been in business for over 30 years and holds an A+ rating from the Better Business Bureau (BBB), which adds to its credibility. Many customers have reported positive experiences, noting that the company provides clear communication throughout the debt settlement process. However, like any company, JG Wentworth has received some complaints, primarily related to the time it can take to complete the debt settlement process and the potential impact on credit.

JG Wentworth’s BBB Accreditation and Ratings

JG Wentworth holds an A+ rating with the Better Business Bureau (BBB), which is a strong indicator of the company’s credibility and commitment to customer service. BBB accreditation is awarded to businesses that meet high standards of trust, transparency, and ethical business practices. The A+ rating reflects JG Wentworth’s ability to address customer complaints and provide satisfactory resolutions.

The BBB rating takes into account several factors, including the company’s length of time in business, complaint history, and how effectively they respond to customer issues. JG Wentworth’s A+ rating signifies that the company has a positive track record in resolving customer complaints and maintaining transparency about its services and fees.

In addition to its rating, JG Wentworth’s BBB profile features customer reviews, where clients share their experiences with the company’s debt relief services. While the majority of reviews are positive, highlighting the company’s professionalism and effectiveness in reducing debt, there are also some complaints regarding the time it takes to settle debts and the impact on credit scores. However, JG Wentworth’s response to these complaints is generally prompt, with efforts made to resolve issues, which helps maintain its strong standing with the BBB.

JG Wentworth Alternatives for Debt Relief

While JG Wentworth Debt Relief is a well-known option for individuals seeking help with unsecured debts, there are several alternatives that may be worth considering, depending on your specific financial situation. These alternatives offer different approaches to managing or eliminating debt, which may be more suited to your needs.

- National Debt Relief

- National Debt Relief is one of JG Wentworth’s primary competitors, offering similar debt settlement services. They negotiate with creditors on behalf of clients to reduce the total amount owed. Like JG Wentworth, they charge fees only after a successful settlement, but their fee structure may differ slightly. National Debt Relief is also highly rated by customers for its transparency and effectiveness.

- Freedom Debt Relief

- Freedom Debt Relief is another major player in the debt settlement industry. They offer a similar process to JG Wentworth but emphasize a more personalized approach to customer service. Clients work with a dedicated debt consultant throughout the settlement process. They also have a strong reputation for reducing debt significantly, though, like all debt relief programs, it can negatively affect credit scores.

- Debt Consolidation Loans

- Debt consolidation loans are a popular alternative to debt settlement programs. With this approach, individuals take out a single loan to pay off all of their unsecured debts, leaving them with only one monthly payment. This can simplify the repayment process and potentially lower interest rates, but it doesn’t reduce the total amount owed, unlike debt settlement. Lenders like SoFi and Marcus by Goldman Sachs offer competitive debt consolidation loan options.

- Debt Management Plans (DMPs)

- For individuals looking for a more structured way to repay their debts, a Debt Management Plan (DMP) through a credit counseling agency could be a good alternative. These plans involve working with creditors to lower interest rates and establish a payment plan, which can make it easier to pay off debt over time. DMPs differ from debt settlement because they focus on repayment rather than reducing the overall debt.

- Bankruptcy

- While it’s often considered a last resort, bankruptcy is another alternative to debt relief. Filing for Chapter 7 or Chapter 13 bankruptcy can discharge or reorganize debts, providing relief for individuals who are unable to pay their debts. However, bankruptcy has long-lasting effects on credit and should only be considered after exploring all other options.

Each of these alternatives offers different advantages and potential drawbacks. For example, debt settlement with JG Wentworth or its competitors may reduce the total amount of debt but could harm your credit score. Debt consolidation loans and DMPs won’t reduce the amount owed but can make repayment more manageable.

Conclusion: Is JG Wentworth Debt Relief Right for You?

Whether JG Wentworth Debt Relief is right for you depends on your financial situation and debt relief goals. For individuals struggling with unsecured debts like credit cards, medical bills, or personal loans, JG Wentworth offers a reliable option with a well-established reputation in the industry. The company’s approach to debt settlement can help reduce the overall amount owed, and the transparent fee structure—where clients are only charged after a successful settlement—adds to its appeal.

However, it’s important to keep in mind that debt settlement, including JG Wentworth’s services, can have a negative impact on your credit score, and the process may take several months to complete. If maintaining a strong credit score is a priority or if you prefer a quicker solution, alternatives like debt consolidation loans or Debt Management Plans (DMPs) may be better options.

Ultimately, if you are looking for a way to lower your total debt and are willing to accept some impact on your credit in the short term, JG Wentworth Debt Relief could be a good fit. It’s essential to weigh the pros and cons, consult with a debt specialist, and consider other options before making a final decision.

By thoroughly reviewing customer experiences, understanding the fee structure, and exploring alternatives, you can make an informed choice about whether JG Wentworth Debt Relief is the right path for your financial future.