When it comes to choosing the right brokerage platform, comparing Webull vs Fidelity is essential for any investor. Both platforms offer unique features and advantages, catering to different types of traders and investment strategies. In this blog post, we’ll dive deep into the key aspects of each platform, from account types and fees to trading tools and customer service, helping you determine which one aligns best with your financial goals. Whether you’re an active trader or a long-term investor, this comparison will give you the insights you need to make an informed decision

Table of Contents

Overview of Webull vs Fidelity

When it comes to choosing an online brokerage, two names often stand out: Webull vs Fidelity. Both platforms offer unique features tailored to different types of investors. Understanding the key differences between Webull and Fidelity can help you decide which platform best suits your needs.

Webull is a relatively new player in the brokerage industry, established in 2017. It quickly gained popularity, especially among younger, tech-savvy investors, thanks to its commission-free trading model. Webull primarily focuses on self-directed trading, offering a streamlined, user-friendly platform that provides access to stocks, ETFs, options, and even cryptocurrencies. The platform is known for its advanced charting tools, technical indicators, and real-time market data, making it a favorite among active traders.

On the other hand, Fidelity is a well-established name in the financial industry, founded in 1946. It has built a reputation as a full-service brokerage that caters to a wide range of investors, from beginners to seasoned professionals. Fidelity offers a comprehensive suite of investment options, including stocks, ETFs, mutual funds, bonds, and retirement accounts like IRAs and 401(k)s. In addition to its investment offerings, Fidelity is known for its robust research tools, educational resources, and exceptional customer service.

While Webull is best for those who prefer a more hands-on, self-directed trading experience with a focus on technical analysis, Fidelity excels in providing a well-rounded, full-service investment experience. Fidelity’s platform is ideal for those who value extensive research, retirement planning, and a wide range of investment options.

Account Types and Minimum

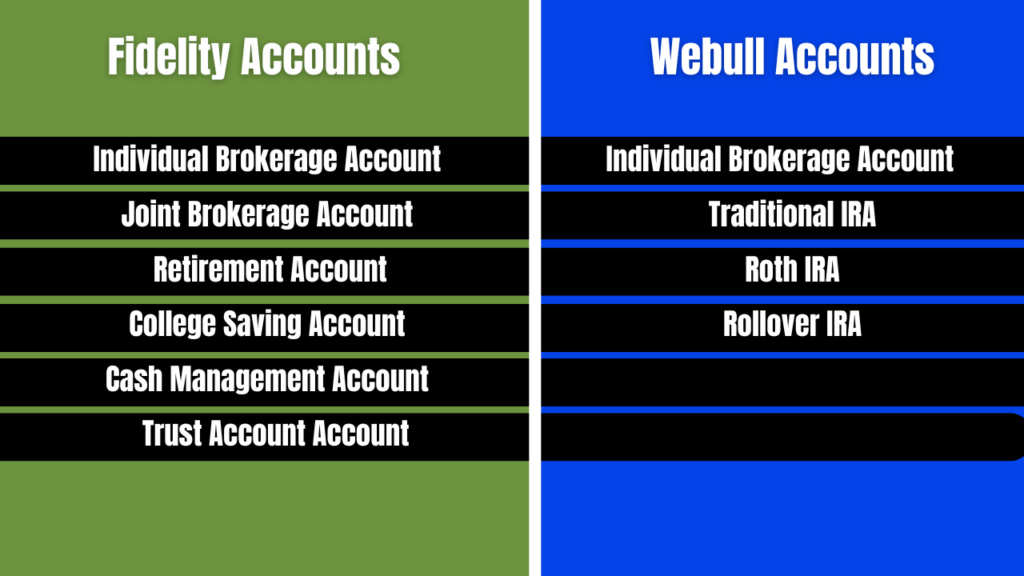

When comparing Webull vs Fidelity, understanding the types of accounts they offer and the minimum requirements is crucial for making an informed decision.

Webull: Account Types and Minimums

Webull offers a straightforward selection of account types, primarily focused on individual and retirement accounts. Here’s a breakdown:

- Individual Brokerage Account: This is Webull’s standard account, allowing users to trade stocks, ETFs, options, and cryptocurrencies. It’s designed for self-directed investors who prefer a hands-on approach.

- Traditional IRA: Webull provides a Traditional IRA, which offers tax-deferred growth on investments. It’s a good choice for individuals looking to save for retirement while reducing taxable income.

- Roth IRA: With a Roth IRA from Webull, users can enjoy tax-free withdrawals in retirement. This account is ideal for those who expect to be in a higher tax bracket in the future.

- Rollover IRA: Webull allows users to roll over their 401(k) or other employer-sponsored retirement plans into a Webull IRA, maintaining the tax advantages.

One of Webull’s standout features is that it has no minimum deposit requirement to open an account. This makes it accessible to new investors who may want to start with a smaller amount of capital.

Fidelity: Account Types and Minimums

Fidelity offers a much broader range of account types, catering to a variety of investment needs. Here are some of the key accounts:

- Individual Brokerage Account: Similar to Webull, Fidelity’s individual brokerage account allows users to trade a wide range of securities, including stocks, ETFs, options, bonds, and mutual funds.

- Joint Brokerage Account: Fidelity also offers joint accounts for multiple owners, making it suitable for partners or family members who want to invest together.

- Retirement Accounts: Fidelity provides a comprehensive selection of retirement accounts, including Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and 401(k) plans. These accounts are designed to help individuals save for retirement with various tax advantages.

- College Savings Accounts: Fidelity offers 529 plans and custodial accounts to help families save for education expenses.

- Cash Management Account: Fidelity’s Cash Management Account functions like a bank account, offering checking features along with FDIC insurance, making it a convenient option for managing daily finances.

- Trust Accounts: Fidelity also supports various trust accounts, which can be beneficial for estate planning purposes.

Fidelity typically requires no minimum deposit for most of its accounts, making it equally accessible to investors of all levels. However, certain specialized accounts, such as some managed accounts, might have higher minimums depending on the service.

Commissions and Fees

When deciding between Webull vs Fidelity, understanding the commission structures and fees associated with each platform is essential. Both platforms offer competitive pricing, but there are some key differences to consider.

Webull: Commissions and Fees

Webull has built its reputation as a commission-free trading platform. Here’s what you need to know about Webull’s fee structure:

- Stock and ETF Trading: Webull offers commission-free trading for U.S. stocks and ETFs. This means you can buy and sell stocks and ETFs without incurring any commission costs, which is particularly attractive to active traders.

- Options Trading: Webull also provides commission-free options trading. While many brokers charge a per-contract fee for options, Webull allows users to trade options without any base commission or per-contract fee.

- Cryptocurrency Trading: Webull enables users to trade cryptocurrencies with no commission fees. However, there is a small spread on crypto transactions, which is the difference between the buy and sell price.

- No Account Maintenance Fees: Webull does not charge any account maintenance or inactivity fees, making it a cost-effective choice for both frequent and occasional traders.

- Additional Costs: While trading is commission-free, Webull does pass on regulatory and exchange fees for certain transactions. These fees are typically very small but should be noted.

Overall, Webull’s commission-free structure makes it an appealing choice for cost-conscious investors who want to maximize their returns.

Fidelity: Commissions and Fees

Fidelity also offers a highly competitive fee structure, particularly for long-term investors and those who value a full-service experience:

- Stock and ETF Trading: Like Webull, Fidelity offers commission-free trading on U.S. stocks and ETFs. This allows investors to build and manage their portfolios without worrying about transaction costs.

- Options Trading: Fidelity charges $0 in base commission for options trades, but there is a $0.65 per contract fee. While this is a low cost, it’s something to consider for options traders comparing Webull vs Fidelity.

- Mutual Funds: Fidelity offers thousands of mutual funds, many of which have no transaction fees. However, for funds that do have fees, the cost can range from $0 to $49.95 per trade, depending on the fund.

- Bonds and CDs: Fidelity charges $1 per bond or CD for online trades, with a minimum of $1 per trade. This fee is relatively low compared to other full-service brokers.

- No Account Maintenance Fees: Fidelity does not charge any account maintenance fees, and there are no minimum balance requirements for most accounts.

- Advisory Fees: For those interested in Fidelity’s robo-advisor or managed portfolio services, advisory fees can range from 0.35% to 1.5% of assets under management, depending on the service.

Fidelity’s fee structure is designed to be transparent and competitive, making it a strong contender for investors who want a blend of low costs and comprehensive services.

| Feature | Webull | Fidelity |

|---|---|---|

| Stock & ETF Trading | Commission-Free | Commission-Free |

| Options Trading | Commission-Free, No per-contract fee | $0 Base Commission, $0.65 per contract fee |

| Cryptocurrency Trading | Commission-Free (small spread applies) | Not Available |

| Mutual Funds | Not Available | No transaction fees for many funds; $0 – $49.95 for others |

| Bonds & CDs | Not Available | $1 per bond/CD (min. $1 per trade) |

| Account Maintenance Fees | None | None |

| Advisory Fees | Not Available | 0.35% – 1.5% (depending on service) |

| Additional Costs | Regulatory & exchange fees may apply | N/A |

Trading Platforms and Tools

When comparing Webull vs Fidelity, the trading platforms and tools available on each can significantly impact your overall trading experience. Both platforms offer robust features, but they cater to different types of investors.

Webull: Trading Platforms and Tools

Webull is known for its sleek, modern trading platforms, which are designed with active traders in mind. Here’s what you can expect from Webull’s offerings:

- Mobile App: Webull’s mobile app is one of its standout features, providing a seamless trading experience on the go. The app is equipped with advanced charting tools, real-time data, and a wide range of technical indicators. It’s highly customizable, allowing traders to set up their workspace to match their preferences.

- Web Platform: Webull’s web-based platform offers a similar experience to the mobile app, with an intuitive interface and powerful tools. It includes features like stock screeners, customizable watchlists, and access to research and news.

- Desktop Platform: For those who prefer trading from a desktop, Webull offers a downloadable platform with advanced charting capabilities, multi-monitor support, and the ability to analyze stocks with up to 50 technical indicators at once. This makes it particularly appealing to day traders and those who rely heavily on technical analysis.

- Paper Trading: Webull also offers a paper trading feature that allows users to practice trading with virtual money. This is a great tool for beginners or anyone looking to test out strategies without risking real capital.

- News and Research: While Webull provides some basic research tools, including financial calendars and news feeds, it is more limited in terms of in-depth research compared to Fidelity. Webull focuses on providing the essential tools needed for active trading.

Fidelity: Trading Platforms and Tools

Fidelity offers a comprehensive suite of trading platforms and tools that cater to a wide range of investors, from beginners to experienced traders:

- Fidelity.com: Fidelity’s primary web platform is designed for ease of use while providing powerful features. It includes advanced stock screeners, portfolio analysis tools, and access to extensive research from third-party providers like Zacks, Morningstar, and S&P Global. The platform is suitable for both casual investors and those looking to dive deeper into research.

- Active Trader Pro: For more advanced traders, Fidelity offers Active Trader Pro, a downloadable platform that provides real-time data, advanced charting, and customizable layouts. This platform is ideal for those who require more sophisticated tools for their trading strategies.

- Mobile App: Fidelity’s mobile app offers a robust trading experience with features like real-time quotes, charting tools, and access to research and news. The app also supports various order types and allows users to manage their accounts and track their portfolios on the go.

- Research and Analysis Tools: Fidelity excels in providing in-depth research tools, including stock screeners, mutual fund analysis, and retirement planning calculators. Users have access to a wealth of data, including analyst reports, earnings estimates, and market commentary.

- Educational Resources: Fidelity offers extensive educational resources, including webinars, articles, and tutorials designed to help investors of all levels improve their trading skills and investment knowledge.

Mobile App Experience

In today’s fast-paced world, the quality of a brokerage’s mobile app can make a significant difference in your trading experience. When comparing Webull vs Fidelity, both platforms offer strong mobile apps, but they cater to slightly different needs and preferences.

Webull: Mobile App Experience

Webull has gained a reputation for its sleek, intuitive mobile app, which is designed with active traders in mind. Here’s what sets it apart:

- User Interface: Webull’s mobile app features a clean and modern interface that’s easy to navigate, even for beginners. The layout is highly customizable, allowing users to arrange their dashboard, watchlists, and charts to suit their preferences.

- Advanced Charting Tools: The app is particularly strong in its charting capabilities, offering a range of technical indicators, drawing tools, and real-time data. Traders can view charts in multiple timeframes and analyze price movements with precision, making it a favorite among day traders and technical analysts.

- Real-Time Market Data: Webull provides free real-time market data, which is essential for active traders. Users can set up alerts and notifications to stay updated on price changes, news, and other market events.

- Commission-Free Trading: Like the desktop version, the mobile app allows users to trade stocks, ETFs, options, and cryptocurrencies without paying commissions. The trading process is seamless, with a few taps enabling users to execute trades quickly and efficiently.

- Paper Trading: Webull’s mobile app also includes a paper trading feature, allowing users to practice trading strategies with virtual money. This is an excellent tool for both beginners and experienced traders looking to test new approaches without risk.

Fidelity: Mobile App Experience

Fidelity offers a mobile app that caters to a broader audience, from beginner investors to experienced traders. Here’s what you can expect:

- User-Friendly Design: Fidelity’s mobile app is designed for ease of use, making it accessible to investors of all levels. The interface is straightforward, with clear menus and easy access to key features like account management, watchlists, and trade execution.

- Comprehensive Features: The app offers a wide range of functionalities, including the ability to trade stocks, ETFs, options, and mutual funds. Users can also manage their retirement accounts, track their portfolios, and access detailed research and news.

- Research and News Access: Fidelity’s mobile app provides users with access to a wealth of research and market analysis, including analyst reports, news updates, and real-time quotes. This makes it easier for investors to make informed decisions on the go.

- Customizable Alerts: Users can set up personalized alerts for price changes, news, and other important events. This feature ensures that you stay informed about the markets and your investments, even when you’re not actively trading.

- Educational Resources: Fidelity’s app includes a range of educational resources, such as articles, videos, and webinars. These are particularly useful for beginners looking to learn more about investing and trading.

- Security Features: Fidelity’s app is equipped with robust security measures, including two-factor authentication and biometric login options, ensuring that your accounts and personal information are well-protected.

Customer Service

Customer service is a crucial factor when choosing a brokerage platform, especially when you need assistance with your account or have questions about trading. In the comparison of Webull vs Fidelity, both platforms offer customer support, but they differ in their approach and availability.

Webull: Customer Service

Webull provides customer support that is primarily accessible through digital channels. Here’s what you can expect:

- Email Support: Webull offers customer service via email, where users can send in their inquiries or issues. Response times are generally quick, but it may not be as immediate as phone support.

- Live Chat: Webull also provides a live chat feature on its website and mobile app, which is convenient for users who need real-time assistance. The chat service is available during market hours, and users typically receive prompt responses to their questions.

- Help Center: Webull’s online Help Center is a comprehensive resource for users who prefer to find answers independently. It includes a wide range of articles, FAQs, and tutorials covering various topics, from account setup to advanced trading features.

- Community Forums: Webull has an active user community where traders can share experiences, ask questions, and learn from each other. While this isn’t a direct form of customer service, it can be a helpful resource for new users.

While Webull’s customer service is efficient and helpful, it lacks the 24/7 availability and phone support that some investors might prefer, especially if they encounter issues outside of standard market hours.

Fidelity: Customer Service

Fidelity is known for its exceptional customer service, offering multiple channels for support and assistance:

- 24/7 Phone Support: Fidelity provides round-the-clock phone support, ensuring that users can get help at any time of the day or night. This is particularly useful for those who trade outside regular market hours or have urgent questions.

- Live Chat: Fidelity also offers a live chat option on its website and mobile app, where users can communicate with a representative in real-time. This feature is available during regular business hours and provides quick, effective support.

- Email Support: Fidelity users can also reach out via email for less urgent inquiries. The response time is generally fast, and the support team is known for being knowledgeable and thorough in their replies.

- Branch Offices: One of Fidelity’s unique advantages is its network of branch offices across the United States. For those who prefer face-to-face assistance, Fidelity allows you to visit a local branch to discuss your needs with a representative.

- Extensive Educational Resources: Fidelity’s website offers a wealth of educational content, including articles, webinars, and videos, designed to help users understand their investments better. While not direct customer service, these resources can often answer common questions or provide guidance on various financial topics.

Fidelity’s comprehensive customer service options make it an attractive choice for investors who prioritize support and assistance, especially those who value the ability to speak directly with a representative at any time.

Promotions and Bonuses

When choosing between Webull vs Fidelity, the promotions and bonuses offered by each platform can be a significant factor, especially for new investors looking to maximize their initial investments. Both Webull and Fidelity offer incentives, but they differ in structure and value.

Webull: Promotions and Bonuses

Webull is well-known for its attractive promotions, particularly aimed at new users. Here’s what you can expect:

- Free Stocks: Webull’s most popular promotion is its free stocks offer. When you sign up for an account and make an initial deposit (typically $100 or more), Webull rewards you with free stocks. The number and value of these stocks can vary, but it’s a great way to start building your portfolio with minimal risk.

- Referral Program: Webull also offers a referral program, where existing users can earn additional free stocks by referring friends or family members. When your referral signs up and meets the deposit requirements, both you and the new user receive free stocks as a reward.

- Periodic Promotions: Webull frequently runs limited-time promotions, such as offering higher-value stocks for deposits above a certain threshold or extra bonuses for trading specific securities. These promotions are often seasonal or tied to special events, so it’s worth checking regularly for new offers.

Webull’s promotions are highly appealing to new investors and those who enjoy the excitement of earning free stocks. However, the value of these bonuses can be unpredictable since it depends on the market value of the awarded stocks.

Fidelity: Promotions and Bonuses

Fidelity takes a more straightforward approach to promotions and bonuses, focusing on long-term value rather than short-term incentives:

- Cash Bonuses for New Accounts: Fidelity occasionally offers cash bonuses for new accounts, particularly for larger deposits. For example, you might receive a cash bonus if you open a new brokerage account and deposit $50,000 or more. The bonus amounts can range from $50 to several hundred dollars, depending on the promotion and deposit amount.

- IRA and 401(k) Rollovers: Fidelity often provides incentives for rolling over IRAs or 401(k) accounts from other financial institutions. These bonuses can include cash rewards or reduced fees, making it a cost-effective option for consolidating retirement accounts.

- Referral Program: Similar to Webull, Fidelity has a referral program that rewards existing customers for bringing in new clients. The referral bonuses typically come in the form of cash, which is credited to your account after the new user meets the required conditions.

- No Account Fees and Low-Cost Funds: While not a traditional promotion, Fidelity’s commitment to no account fees, no minimums, and access to zero-expense-ratio index funds is a significant value proposition. These features can lead to substantial savings over time, especially for long-term investors.

Fidelity’s promotions are generally geared toward investors with larger portfolios or those looking to consolidate assets, offering more stable and predictable bonuses compared to Webull’s free stocks.

Final Verdict: Who Should Choose Which?

After comparing Webull vs Fidelity across various categories, it’s clear that both platforms have their strengths, catering to different types of investors. Your choice between Webull and Fidelity should depend on your trading style, investment goals, and personal preferences.

Who Should Choose Webull?

Webull is an excellent choice for:

- Active Traders: If you’re an active trader who enjoys using advanced charting tools and technical indicators, Webull’s platforms are designed with you in mind. The mobile app’s robust features and customizable interface make it easy to trade on the go.

- New Investors Seeking Low-Cost Entry: With no account minimums and commission-free trading on stocks, ETFs, and options, Webull is perfect for beginners who want to start investing without upfront costs.

- Tech-Savvy Investors: Webull’s sleek, modern interface and focus on technology will appeal to those who appreciate a user-friendly, yet powerful, trading experience.

- Promotion Seekers: If you’re drawn to promotions like free stocks and referral bonuses, Webull’s ongoing offers can add extra value to your account.

Who Should Choose Fidelity?

Fidelity is the better option for:

- Long-Term Investors: Fidelity’s extensive research tools, educational resources, and broad range of investment options make it ideal for those focused on long-term wealth building and retirement planning.

- Investors Seeking Comprehensive Support: With 24/7 customer service, a network of branch offices, and access to in-depth research, Fidelity provides unparalleled support and guidance, which is especially valuable for beginners and those with complex financial needs.

- Large Account Holders: Fidelity’s promotions, such as cash bonuses for significant deposits and IRA rollovers, are more advantageous for investors with larger portfolios.

- Diverse Investment Preferences: If you’re interested in mutual funds, bonds, or managed accounts, Fidelity offers a wider variety of investment products compared to Webull, making it a better fit for diversified portfolios.

Comparison Table: Webull vs Fidelity

| Feature | Webull | Fidelity |

|---|---|---|

| Account Types & Minimums | Individual brokerage; No minimums | Wide variety; No minimums for most |

| Commissions & Fees | Commission-free trading | Commission-free; some mutual funds may have fees |

| Trading Platforms & Tools | Mobile, web, desktop; Advanced charting | Web, desktop, mobile; Comprehensive tools and research |

| Mobile App Experience | Sleek, customizable, real-time data | User-friendly, access to research |

| Customer Service | Email, live chat, Help Center | 24/7 phone support, live chat, branch offices |

| Promotions & Bonuses | Free stocks, referral bonuses | Cash bonuses, IRA rollovers, referral bonuses |